How do you know if your financial health is fine or not? Just take a look at the credit score! The better it is, the easier it is to get the green light for new lines of credit or new loans. Credit scores range between 300 and 850. If you have a score between 580 and 669 it is fair. Those with a good score come between 670 and 739, while 740 to 799 is considered very good. In case your score goes above 800, it is excellent. If you want to boost your credit score, you have to get on it right away, as it could be a few months before you witness any credit improvement.

Resolve collections and charge-offs

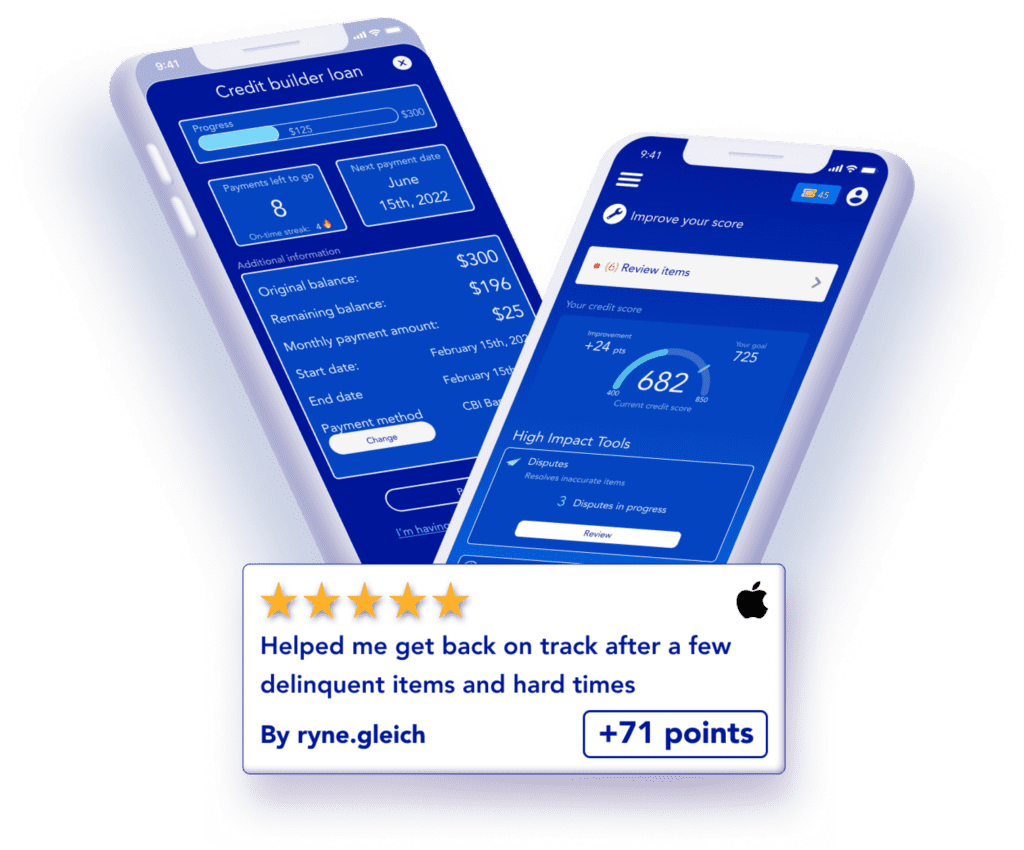

Cambio – Fix bad credit, build good credit

So here is what you can do for credit improvement – take a look:

Checking credit reports is the first step towards credit improvement

Get a copy of your credit report from Equifax, Experian, and TransUnion (three major national credit bureaus). Sit down and take a peek at what is helping or hampering credit improvement. To maintain a good credit score, you have to make timely payments, keep low balances on credit cards, have minimal inquiries for new credit, and so on. So what makes your score plummet? If you fall behind on payments or have high credit card balances, it negatively impacts the credit score.

Late or missed payments will affect your credit improvement process so avoid it.

Payment history makes up 35% of your credit score. So pay off debts as quickly as you can, and don’t pay bills late. What you can do not to fall behind on payments is to create a filing system – it could be either paper or digital, in order to keep track of monthly bills. When a bill is due, set an alert so you don’t miss or forget about it. Another way is to automate few bill payments from your bank account. If you wish to simplify bill payments and boost credit score, you could charge all or as many as possible of monthly payments to a credit card. It means you pay the balance in full every month to avoid interest charges.

Minimize requests for new credit and hard inquiries

A soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, reviews by financial institutions with which you conduct business, and so on. They don’t impact credit score in any way. Hard inquiries are when you apply for mortgage, credit cards, auto loans, or some other form of new credit. Several hard inquiries over a short period of time could damage your credit score. For instance, banks could take it as a sign that you require money due to financial problems, hence you are bigger risk. When it comes to credit improvement, you should steer clear of new credit for a while.

Dial down your credit utilization

This is the part of your credit limit that you use at any given time. Pay your credit card balances in full every month. In case it isn’t possible for you to stick to that, keep the total outstanding balance at 30% or less of the total credit limit. Your work doesn’t end there as you have to reduce it to 10% or less, to raise your credit score. Alternatively, you can request an increase in credit limit as it improves credit utilization. But your balance shouldn’t increase simultaneously. Use your credit card’s high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Consolidate debts

Do you have outstanding debts? Take out a debt consolidation loan from a credit union and bank, and pay off all your debts. Then you have a single payment to deal with every month, and the interest rate will be lower. Thus, you can pay off that one debt much quicker, which improves credit utilization ratio and credit score as well. A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. But take balance transfer charges into account that can cost 3% to 5% of the amount of your transfer.

Fatten up your credit file for credit improvement.

A thin credit file means you don’t have sufficient credit history to generate a credit score. But there are ways to fatten it up. Try Experian Boost – it is a new program that collates financial data like history and utility payments and includes that in calculating your Experian FICO Score. It is free and apt for those who have positive bill payment history. UltraFICO works too – it is free, and uses banking history to compute FICO score.

Keep old accounts open helps credit improvement

There is an age of credit portion, which makes up 15% of the credit score. It takes into account how long you have had credit accounts – the older they are; the more favorable it looks to lenders. Have old credit accounts that you don’t use anymore? Don’t close them. Yes, the credit history for those accounts remains on the credit report. But if you close the credit cards while there is a balance on other cards, it lowers your available credit and increases your credit utilization ratio. It hampers credit improvement by decreasing the credit score.

Moreover, if you have delinquent accounts, charge-offs, or collection accounts, resolve them as soon as possible. For instance, if there is an account with several late or missed payments, work out a schedule to make future payments on time. If you have charge-offs or collection accounts, decide whether it makes sense to either pay off those accounts in full or offer the creditor a settlement.

To check if there has been any credit improvement or not, you could use a credit monitoring service. They are generally free and track changes in your credit report, such as a new account or one that is paid off. But as mentioned before, you won’t see any changes soon, so be patient. Don’t fall into the trap of credit repair services that promise instant credit repair, as those are scams to trick you!