Free Credit Dispute Letter Template PDF

Items on your credit report hurting your credit score? Download our most effective dispute letter!

-

Cambio's most effective dispute letter template

-

Designed to remove hurtful inaccuracies

-

Template tested continuously for best results

-

Simple, easy to follow instructions

Disclaimer: By pressing "Generate free dispute" you agree to receive email correspondence from Cambio Financial Health Inc. and assume full responsibility for any action you take to affect your credit report. Cambio Financial Health Inc. does not guarantee any improvements to your credit score, or derogatory item deletions.

Or, let Cambio do the hard work!

What is a credit dispute letter?

Definition: This dispute letter template, once filled out, can be sent to the credit bureaus to remove inaccurate accounts such as charge-offs, collection accounts, or any other inaccurate information on your credit report.

What information should I put in this template?

Did you know 1/3 credit reports contain a mistake? This dispute template removes those hurtful mistakes from your credit report. Once removed, the inaccurate mistake will no longer hurt your credit score.

Before filling out this template, get your credit report from each of the three credit bureaus. You can do so on the credit bureaus' websites or download, Cambio. We'll show you exactly what's hurting your credit score and manage your disputes for you.

Now that you have your credit report, scan it for inaccuracies. Pay special attention to hurtful accounts such as collection and charged-off accounts.

What is considered an "inaccuracy" on my credit report?

An inaccuracy is any piece of information on your report that should not be there. Typically, these inaccuracies fall into one of these buckets:

1: Inaccurate information - This could be incorrect payment history, your account number is incorrect, the balance due is incorrect, etc.

2: The account is not yours - Any information on your report that you suspect is not yours should be disputed.

3: The account is a result of identity theft - Identity theft is a major cause of bad credit. If you are seeing information on your credit report that is a result of identity theft, attach copies of any evidence such as police reports to your mailed dispute.

Can disputes hurt my credit score?

According to the Fair Credit Reporting Act, you have a right to an accurate and verifiable credit report. Disputing information on your credit report can never hurt your credit score.

I filled out the dispute template, now what?

Once you have inputted your information into our free credit dispute template, it's time to mail it to each of the credit bureaus that are reporting this information. You can find each of the three major credit bureau mailing addresses here:

Equifax

P.O. Box 7404256

Atlanta, GA 30374-0256

Experian

Dispute Department

P.O. Box 9701

Allen, TX 75013

TransUnion

Consumer Solutions

P.O. Box 2000

Chester, PA 19022-2000

Once mailed, you can expect the dispute to take 30 - 45 days to process.

Don't have the time? Cambio makes credit disputes easy!

How it works

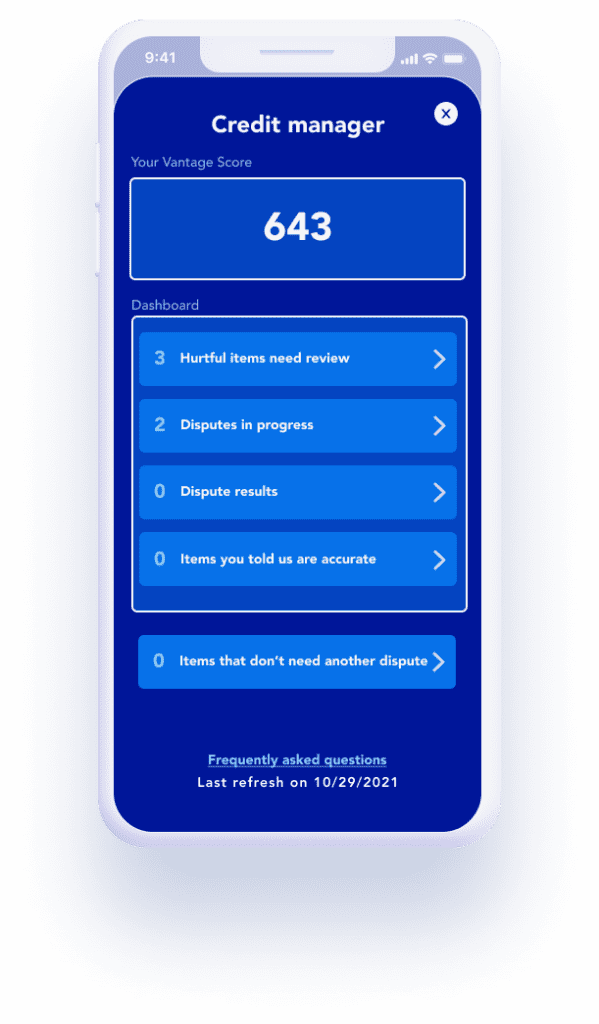

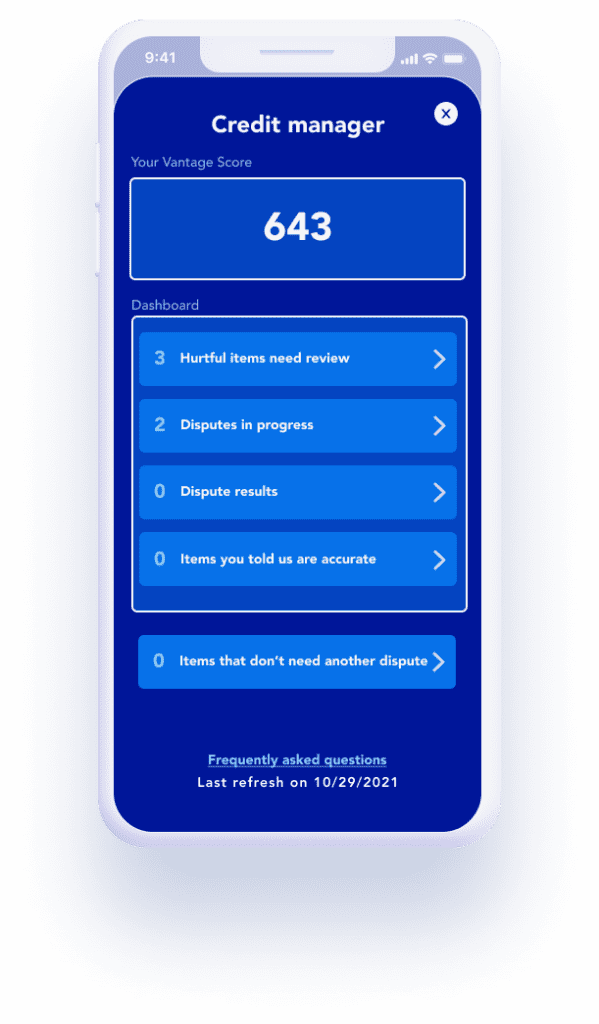

Auto-Identify

We analyze your credit report for items hurting your credit score

Let us do the heavy lifting. Immediately identify what’s hurting your credit score.

Auto-identify

We analyze your credit report for items hurting your credit score

Let us do the heavy lifting. Immediately identify what’s hurting your credit score.

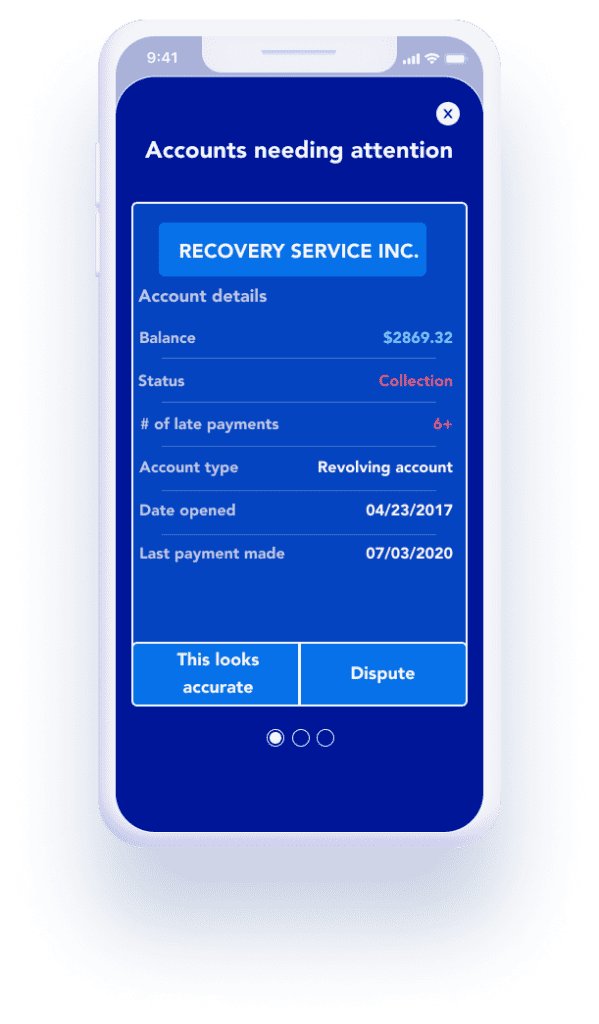

One-click disputes

Boost your credit score by resolving negative items

We use a proprietary algorithm to give you the best chance of removing negative items from your credit report.

One-click disputes

Boost your credit score by resolving negative items

We use a proprietary algorithm to give you the best chance of removing negative items from your credit report.

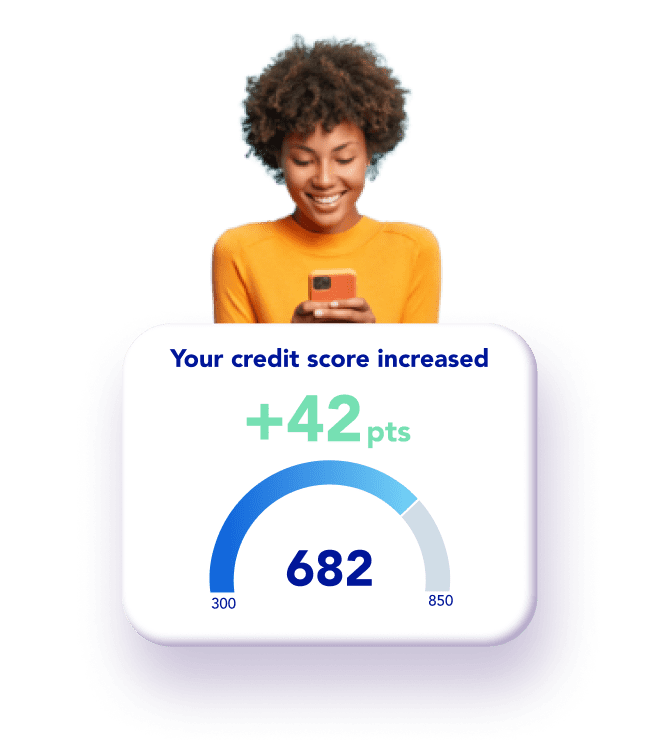

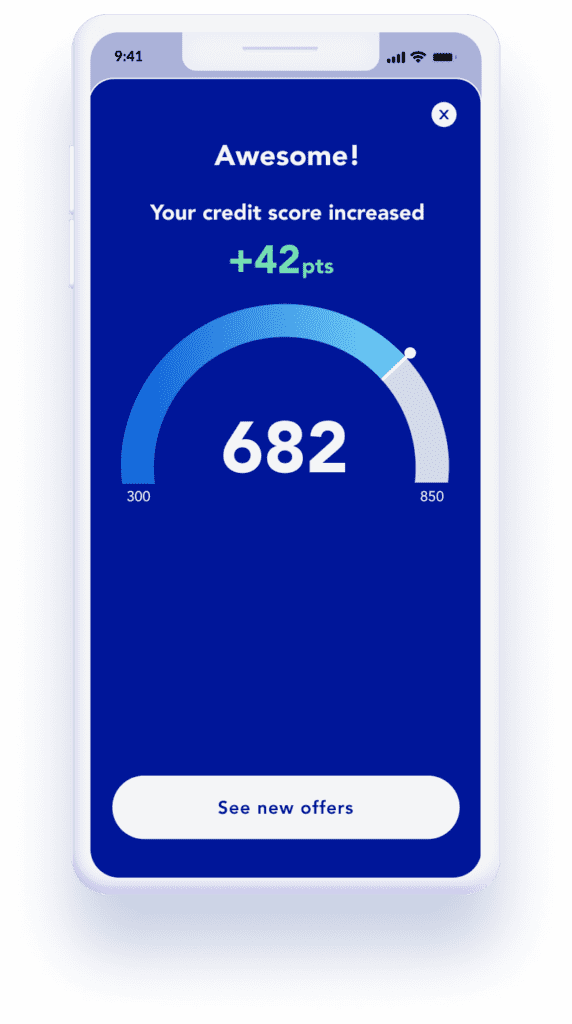

Track your progress

Sit back and watch your score improve!

Most members start to see results in just 2 months

Track your progress

Sit back and watch your score improve

Most members start to see results in less than 2 months!

Enjoy better credit

Put bad credit behind you

Sign up today and start living your life without the stress of bad credit!

Enjoy better credit

Put bad credit behind you

Sign up today and start living your life free from the stress of bad credit.

Bad credit? We can help

Check out our other credit tools

Monthly analysis

Use our powerful AI to find how else you can improve your credit score each month

Remove hurtful mistakes

Grow your credit score by 100 points! Resolve items hurting your score quickly and easily

Become a credit pro

Complete daily money challenges to boost your skills and master your finances!

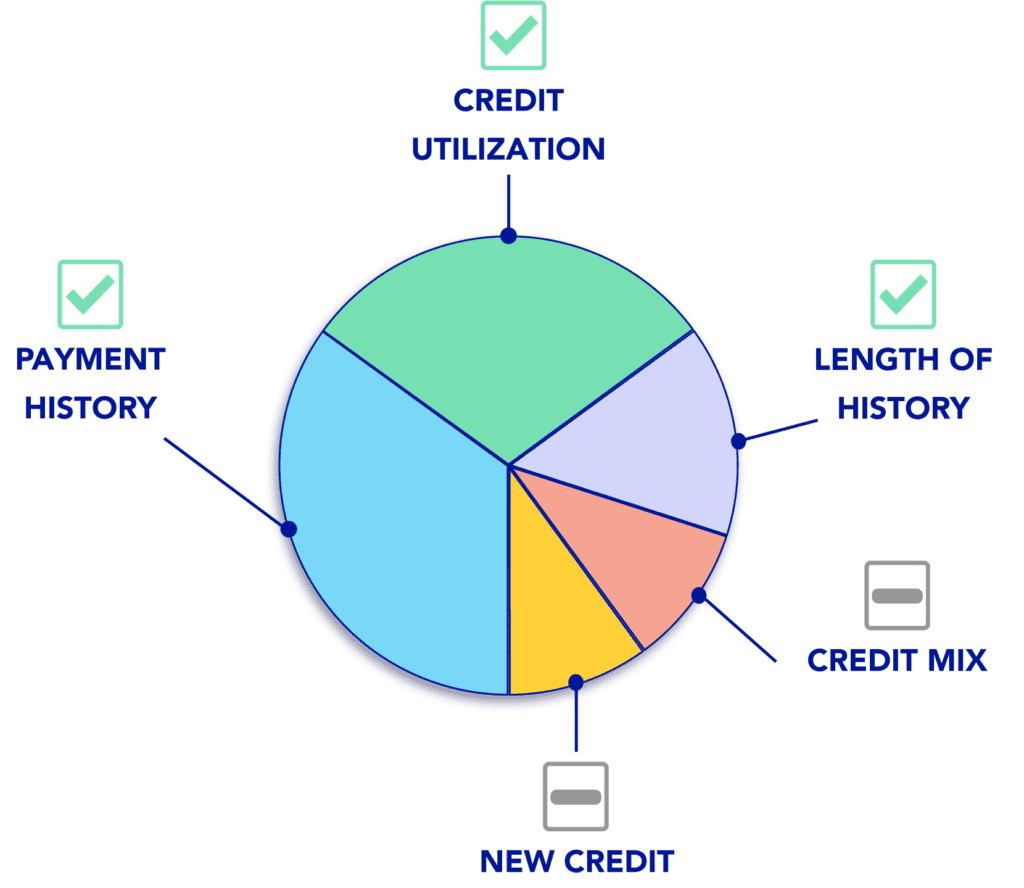

Impact your credit score

Smart credit building

The credit builder loan targets the most important factors of your credit score

Why is your credit score important?

Your score can get you...

-

A new car - auto-loan companies check your score

-

A new home - mortgage providers determine how much they'll charge you based on your credit score

-

Rental opportunites - Landlords often check credit scores

-

Employment - your future employer may check on your credit score

-

The best credit card - your score determines how expensive your monthly payments are. A better credit score can also mean better rewards