Download Your Free Pay for Delete PDF Template Below!

Or, let Cambio do it for you!

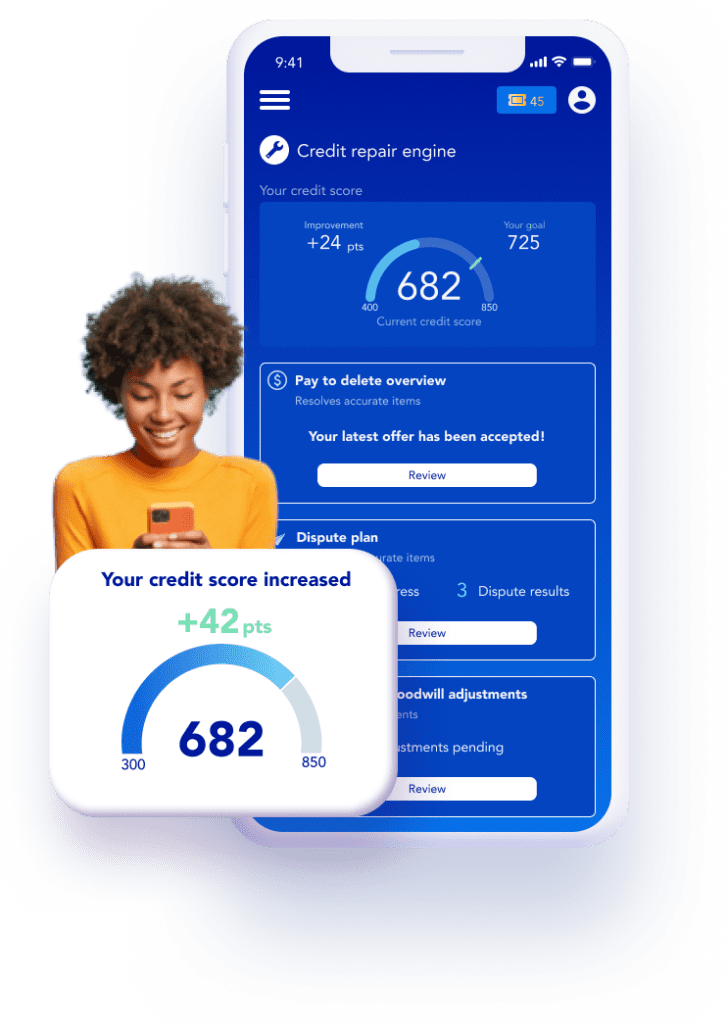

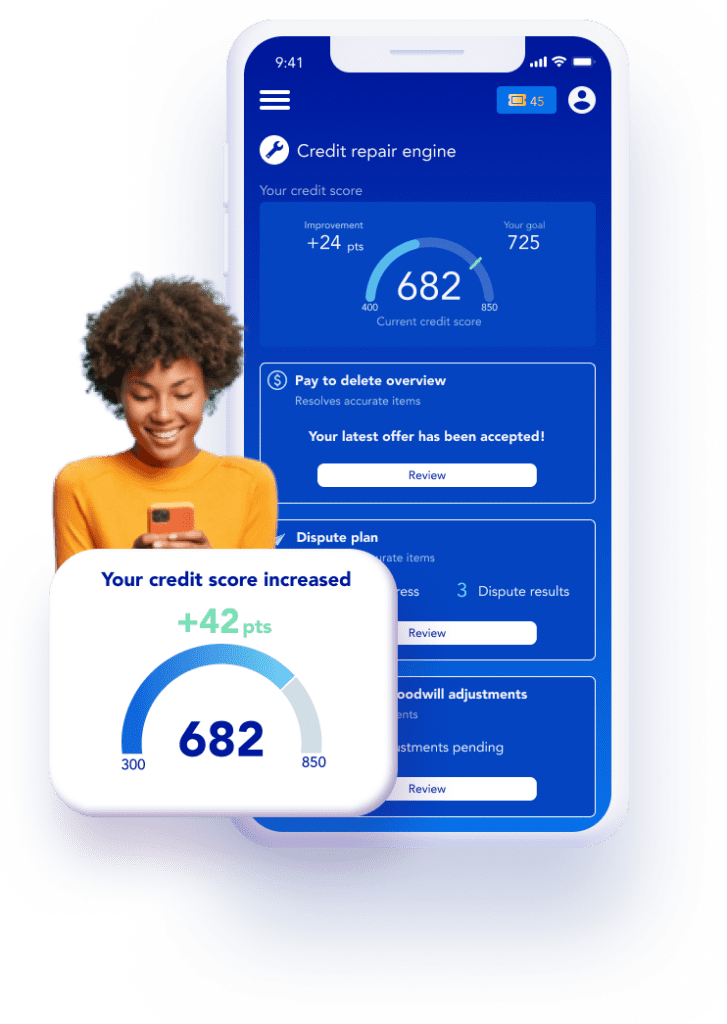

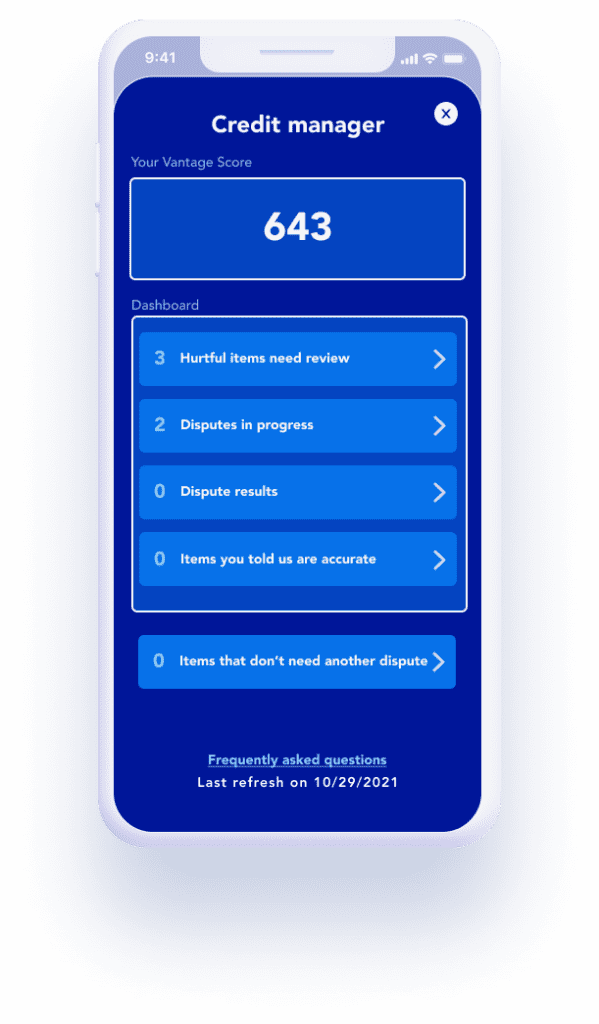

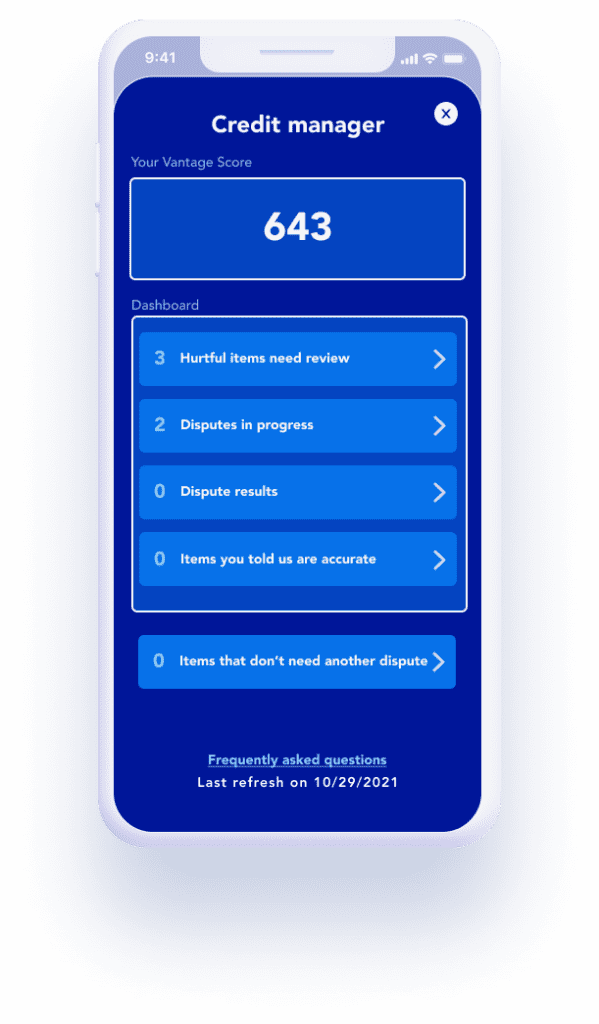

A credit specialist in your pocket

- Send and track your pay to delete offers

- Find and resolve ALL items hurting your score

- Come out on top of your collection negotiations

Read on for the template and guide

Download Your Free Pay to Delete PDF Template

Enter your email to download your free Pay to Delete PDF template

Disclaimer: By pressing "Download" you agree to receive email correspondence from Cambio Financial Health Inc. and assume full responsibility for any action you take to affect your credit report. Cambio Financial Health Inc. does not guarantee any improvements to your credit score, or derogatory item deletions.

Pay to delete - Simple Strategy To Remove Collections and Boost Your Credit Score

If you’re like many of us, you’ve probably racked up a few bills and gone into collections. And if you’re like many of us, you’re trying to figure out how to get out of debt quickly and efficiently. Fortunately, there is a way you can pay to delete an account in collections and start rebuilding your credit. In this blog post, we’re going to discuss what pay to delete is, how it works, the benefits of using it, when to avoid it, and strategies for success. Let’s dive in!

What is pay to delete?

Pay to delete is a strategy you can use to negotiate with creditors and collections agencies and have them delete the account from your credit report in exchange for a payment. This can be a great way to get out of debt quickly and start rebuilding your credit score.

When you pay to delete, you are agreeing to make a payment in exchange for the creditor or collections agency to delete the account from your credit report. This means that your credit score will improve, since the account will no longer appear on your report.

The amount you pay will depend on the creditor or collections agency. Some may require a full payment, while others may be willing to accept a partial payment. It all depends on the individual creditor or collections agency.

How Pay To Delete Works

The process of pay to delete is relatively simple. First, you need to reach out to the creditor or collections agency and inquire if they are willing to accept a pay to delete agreement. If they agree, you can then negotiate the terms of the agreement. This includes the amount you will pay in exchange for the account to be deleted from your credit report.

Once you reach an agreement, you can make the payment and the creditor or collections agency will delete the account from your credit report. It is important to note that the account will not be immediately deleted from your credit report. It can take up to 30 days for the account to be removed from your credit report.

Benefits of Pay to delete

There are many benefits of using pay to delete as a way to get out of debt and improve your credit score. One of the main benefits is that it can help you get out of debt quickly. By making a payment to the creditor or collections agency, you can avoid more costly payment plans and interest charges.

Another benefit of pay to delete is that it can help you improve your credit score. By having the account deleted from your credit report, your credit score will improve. This can open the door to more opportunities in the future, such as getting approved for a loan or a credit card.

Reaching out to creditors

Once you’ve decided to use the pay to delete strategy, the next step is to reach out to the creditor or collections agency and inquire about a pay to delete agreement. Make sure to be polite and professional when reaching out, as this can help improve your chances of a successful negotiation.

When reaching out, make sure to explain your situation and why you are unable to make the full payment. You should also explain that you are interested in a pay to delete agreement and inquire if they are willing to accept such an agreement.

Negotiations and payment agreements

Once you’ve reached out to the creditor or collections agency, it’s time to start negotiating. Make sure to be reasonable and explain that you are unable to make the full payment. This will help increase your chances of a successful negotiation.

Once you’ve reached an agreement, make sure to get the terms in writing. This can help protect you in case the creditor or collections agency does not follow through with their end of the agreement.

When to avoid pay to delete

There are some cases when you should avoid using this strategy. For example, if the creditor or collections agency is not willing to accept a pay to delete agreement, then it may be best to try a different strategy.

In addition, if the creditor or collections agency is not willing to delete the account from your credit report, then it may be best to avoid the pay to delete strategy. This is because the account will still appear on your credit report, which can hurt your credit score.

Instead, you may want to consider disputing the collection account at each of the three credit bureaus if you believe the item to be inaccurate. Cambio makes this process easy with a free credit analysis.

Or let Cambio do the hard work!

Don't have the time? Cambio makes improving your credit easy!

How it works

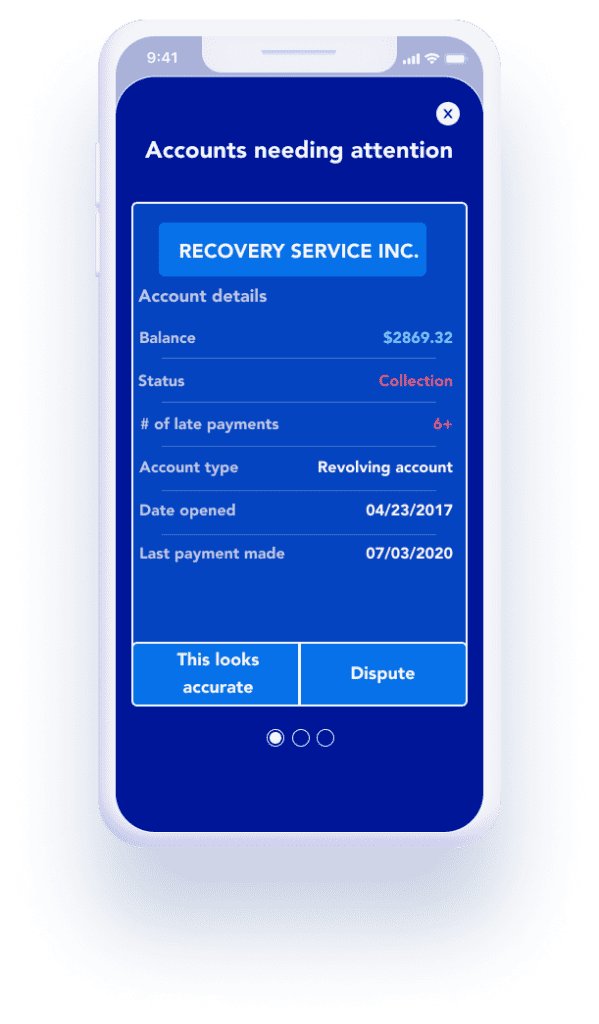

Auto-Identify

We analyze your credit report for items hurting your credit score

Let us do the heavy lifting. Immediately identify what’s hurting your credit score.

Auto-identify

We analyze your credit report for items hurting your credit score

Let us do the heavy lifting. Immediately identify what’s hurting your credit score.

One-click disputes

Boost your credit score by resolving negative items

We use a proprietary algorithm to give you the best chance of removing negative items from your credit report.

One-click disputes

Boost your credit score by resolving negative items

We use a proprietary algorithm to give you the best chance of removing negative items from your credit report.

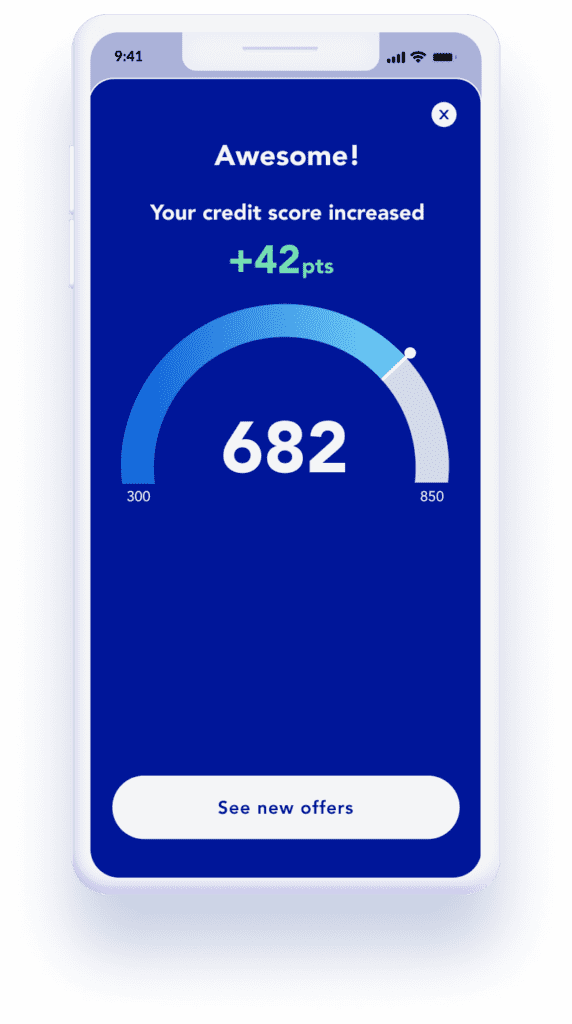

Track your progress

Sit back and watch your score improve!

Most members start to see results in just 2 months

Track your progress

Sit back and watch your score improve

Most members start to see results in less than 2 months!

Enjoy better credit

Put bad credit behind you

Sign up today and start living your life without the stress of bad credit!

Enjoy better credit

Put bad credit behind you

Sign up today and start living your life free from the stress of bad credit.

Bad credit? We can help

Check out our other credit tools

Monthly analysis

Use our powerful AI to find how else you can improve your credit score each month

Remove hurtful mistakes

Grow your credit score by 100 points! Resolve items hurting your score quickly and easily

Become a credit pro

Complete daily money challenges to boost your skills and master your finances!

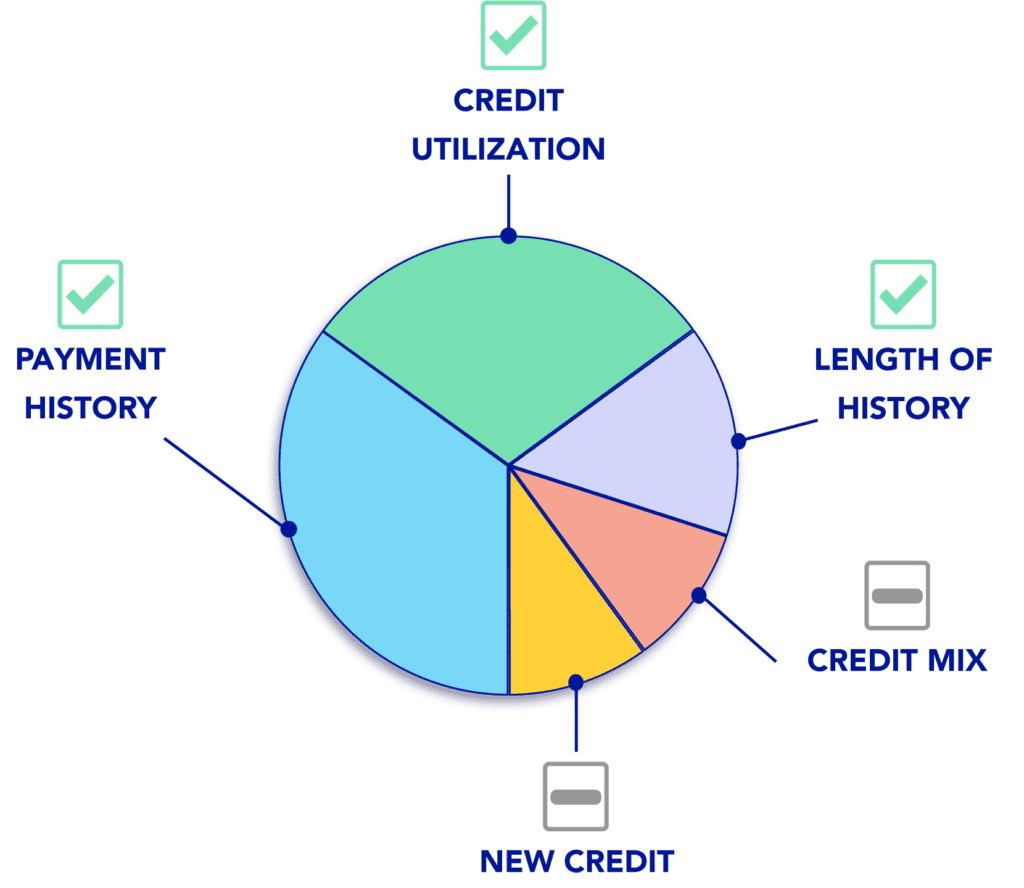

Impact your credit score

Smart credit building

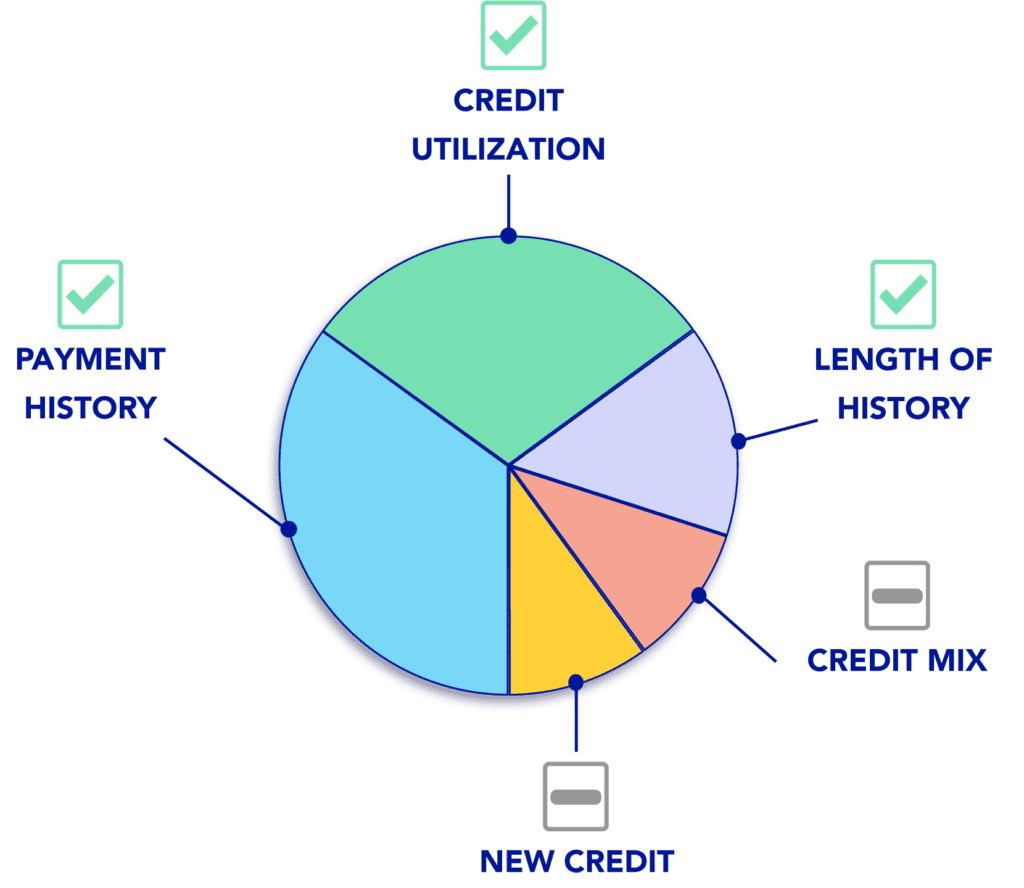

The credit builder loan targets the most important factors of your credit score

Why is your credit score important?

Your score can get you...

-

A new car - auto-loan companies check your score

-

A new home - mortgage providers determine how much they'll charge you based on your credit score

-

Rental opportunites - Landlords often check credit scores

-

Employment - your future employer may check on your credit score

-

The best credit card - your score determines how expensive your monthly payments are. A better credit score can also mean better rewards