Credit recommendation engine

Improve your credit at 87% of the cost

✓ Credit report refresh every 30 days

✓Get recommendations on items hurting your credit score

✓ Everything you need to verify and resolve items hurting your score

✓ Monitor your credit report month to month

Try Cambio for free, no card or payment required!

CambioTM is a financial wellness company, not a bank. Banking services provided by Services Credit Union.

How it works

![]() Let us identify items hurting your score

Let us identify items hurting your score

We’ll do a soft pull of your credit, that doesn’t harm your credit, and analyze your credit report for items hurting your credit score.

![]() Get recommendations

Get recommendations

We will tell you which items are hurting your credit score and actions you can take to correct those items.

![]() Automatically track your progress

Automatically track your progress

Try Cambio for free, no card or payment required!

CambioTM is a financial wellness company, not a bank. Banking services provided by Services Credit Union.

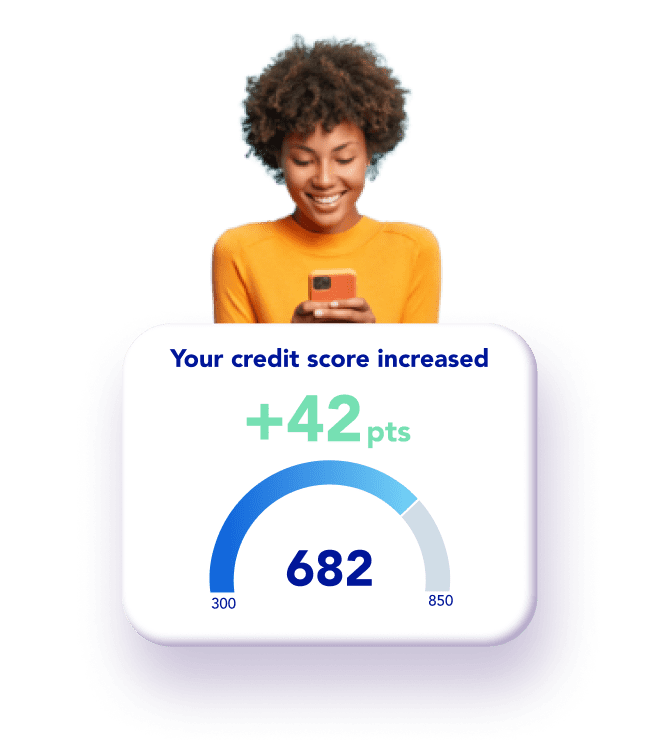

Credit score impact

1 in 5 consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one

FAQs

A credit score is between 300 and 850, and represents your credit risk, or the likelihood you will pay your bills on time.

Cambio provides a VantageScore from Transunion. Factors include:

- Payment history (40%, extremely influential): are you paying your debt and bills on time

- Credit age and mix (21%, highly influential): the age and type of loan accounts you have

- Credit utilization (20%, highly influential): the amount of credit you’ve used

- Balances (11%, moderately influential): current unpaid debt

- Recent credit applications (5%, less influential): how many new applications for credit have you applied for recently

- Available credit (3%, less influential): how much of your available credit are you using

A good credit score can:

- Get you lower interest rates on loans

- Help you refinance high-interest loans

- Help you get approved for rent

- Help you borrow money for a home

- Get you a lower monthly premium on insurance like auto insurance

- Impact your chances of getting a job

Most traditional banks and lenders want a credit score above 670 to be considered reliable

Hard inquiries (aka hard pulls) generally happen when a bank or lender, checks your credit when making a lending decision for a credit card or loan. A hard inquiry could lower your scores by a few points, but multiple hard inquiries in a short period could have a bigger impact on your score.

Soft inquiries (aka soft pulls) generally happen when a person or company checks your credit and DOES NOT impact or hurt your credit score. Cambio only performs soft inquiries when providing you access to your credit report.

All users get the following services for free from Cambio:

- Money Manager: tool to help you budget and manage your money

- Credit Score: get a Transunion VantageScore for the first 30 days of your membership

- Automated credit analysis: understand what is hurting or helping your credit score

Credit Manager helps you identify items hurting your score. You are given the tools to put you in control to resolve inaccurate items that are impacting your credit score with the bureaus.

Using Credit Manager does not guarantee an increase in your credit score, and individual results may vary.

You need to have a preferred membership to have Collections Manager. You will only be recommended Collections Manager if we identify a negative item impacting your score.

Most members start to see results in less than 2 months.

Using Collections Manager does not guarantee an increase in your credit score, and individual results may vary.

Try Cambio for free, no card or payment required!

CambioTM is a financial wellness company, not a bank. Banking services provided by Services Credit Union.

Over 100 million Americans need a way to rebuild financially

You aren't alone, Cambio is by your side to help you rebuild safely!

Security

Your data has 256-bit encryption, same security as a bank

Protected

We do not resell your data to 3rd parties

Try Cambio for free, no card or payment required!

CambioTM is a financial wellness company, not a bank. Banking services provided by Services Credit Union.