Road to 1 Million Points

Week 1 | Your Credit and You

Credit score points added so far

Last updated January 25th, 2023

Week 1 | Your Credit and You

What we'll learn in the next 10 minutes

Staying Motivated

How will you stay motivated on your credit building journey?

Laying the foundation

A crash course on the basics

Staying Motivated

As humans, we often fall short of our goals. Some we’ve accomplished while others we’ve barely started on. If you’re here, you probably have a goal of improving your credit score. Our job is to make sure you accomplish this.

Your BIG WHY

A Big Why is a driving force that motivates you to work towards a goal despite the obstacles you might encounter. Building credit can be tough and often takes time. Your big why will push you through any challenges on your way to reaching your credit goals.

1 MILLION POINT ACTIVITY

Finding your BIG WHY

Step 1: Finish this sentence on a piece of paper. I want to improve my credit score because…

Step 2: Take that answer and ask yourself “Why?”

For example, if you wrote down, “I want to improve my credit score because I want to own my own home one day” Ask yourself, WHY you want to own a home. Maybe it is to support your family. Maybe you want to be independent. Take a moment to think through WHY you are working on your credit.

Step 3: Repeat this process until you find your BIG WHY.

Ask yourself “Why?”, again until you arrive at an answer that you connect with emotionally. Your BIG WHY should fire you up about improving your credit score. It’s something you should feel emotional about.

Once you have your BIG WHY written down, copy it onto a post-it note and put it somewhere you will see often. Remind yourself of your BIG WHY often and lean on it to get you through any challenges you might experience along our Road to 1 Million Points.

How will you stay motivated on your credit building journey?

SMART credit goals

Unfortunately, “improving my credit score”, is difficult to work towards. Where do you start? Is it enough to improve 20 points or do you need to add 100? Our first step on this road will be transforming this vague, unhelpful goal into your first SMART credit goal.

SMART goals are scientifically-proven to be more achievable. You might have heard of them. If not, here’s a refresher. Smart goals are:

- Specific: Clearly defined and detailed.

- Measurable: Designed in a way that allows you to determine whether the goal was accomplished.

- Attainable: Achievable with hard work, and in consideration of your current skills and abilities.

- Relevant: Aligned with your other goals.

- Time-based: They are linked to a time frame.

Here’s an example.

One of your goals may be to improve your credit score. As you’ll learn later, one way to do this is to lower your credit card balances. Here’s one way we could break it down into a SMART goal:

One of your goals may be to save more money each month. Saving money is a great long-term goal but it’s difficult to accomplish quickly. A short-term SMART goal could be to save $100 from your paycheck each time you get paid. As a SMART goal, it’d look like this: I will transfer $100 (specific, measurable) from each paycheck (attainable, realistic), for the next 2 paychecks (time-based).

Laying the foundation | Credit Simplified

Credit is a tool. But to use it properly, there are a few ground rules you should know about.

Why Credit Exists

Credit, at it’s simplest, is the ability to use other people’s money to further your own goals. You borrow money to get a car so you can get to work. Or to have a place to live. Or to pay your doctor’s bills.

Banks and lenders make money by providing loans and charging a fee for those loans. So, the biggest question they have when you walk in to apply for a loan is:

“Will this person pay me back?”

If they believe you are worthy of their trust, you are considered creditworthy, meaning you have “good credit”.

How Credit Works

Lenders determine how likely you are to repay them using your credit history. This history is contained in your credit report.

A credit report contains information about how you have used credit in the past. Information like…

- The number of loans or credit cards you have opened and closed

- How many on-time and late payments you’ve made on a loan or credit card

- Credit card balances and limits

- How many times you’ve tried to open a loan or credit card

Essentially, your credit report contains all of the information a lender would need to answer the question, “Will this person pay me back?”

Lenders pull your credit report from each of the 3 major credit bureaus, Experian, Equifax, and TransUnion.

Your Credit Score

Your Credit Score is your credit history boiled down to a single number. It’s a tool for lenders to quickly determine how creditworthy you are. It ranges from 300 to 850.

300 means you likely will not repay the lender. 850 is perfect meaning you will almost certainly repay the lender.

Contrary to popular belief, there is more than one credit score. In fact, there are dozens of credit scores.

When you check your credit score using an app or website, you may find it’s different than what your bank told you it was on your last loan application. This is because lenders may use a slightly unique score to make their decisions.

1 MILLION POINT ACTIVITY

Check YOUR credit

Step 1: Get your Credit Report.

Request your credit report from each of the three credit bureaus at annualcreditreport.com. We’ll show you how to read and analyze your credit report it in Week 2.

Step 2: Check your Credit Score

You can find your credit score by creating an account on one of the 3 major credit bureaus’ websites.

Complete both steps in one by downloading Cambio!

How will you stay motivated on your credit building journey?

Week 2 | Coming soon!

Bad credit? We can help

Check out our other credit tools

Monthly analysis

Use our powerful AI to find how else you can improve your credit score each month

Remove hurtful mistakes

Grow your credit score by 100 points! Resolve items hurting your score quickly and easily

Become a credit pro

Complete daily money challenges to boost your skills and master your finances!

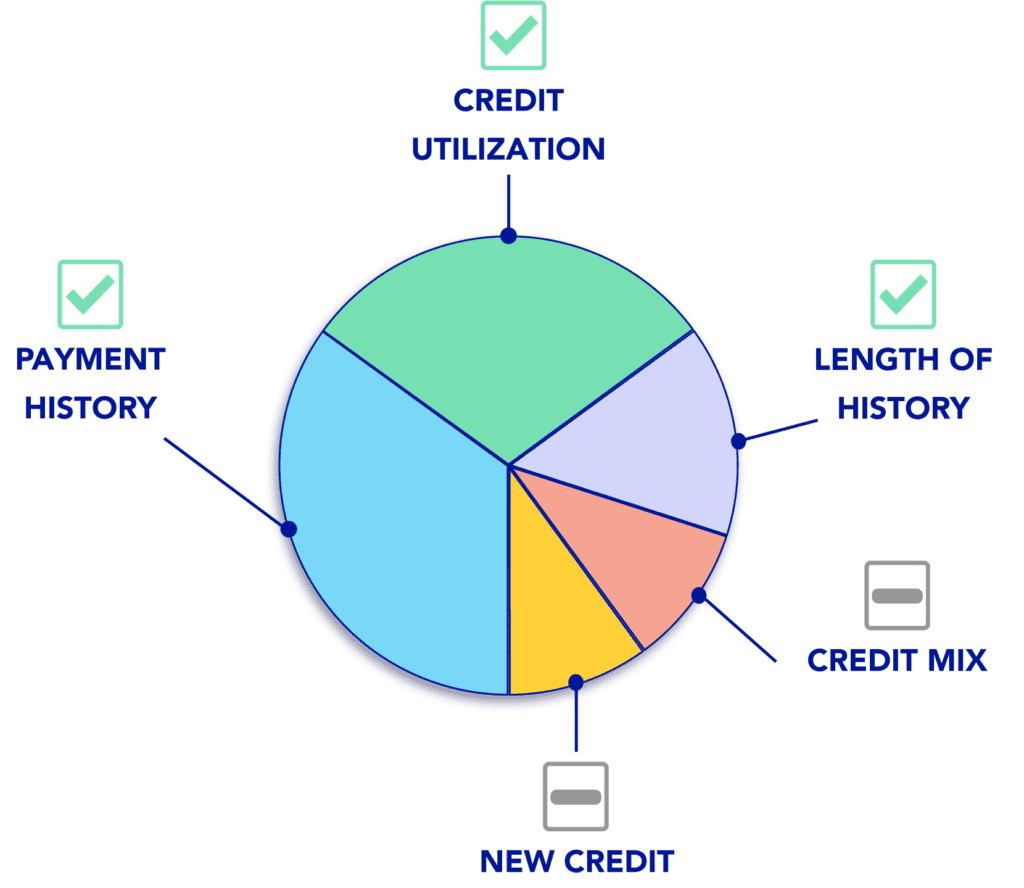

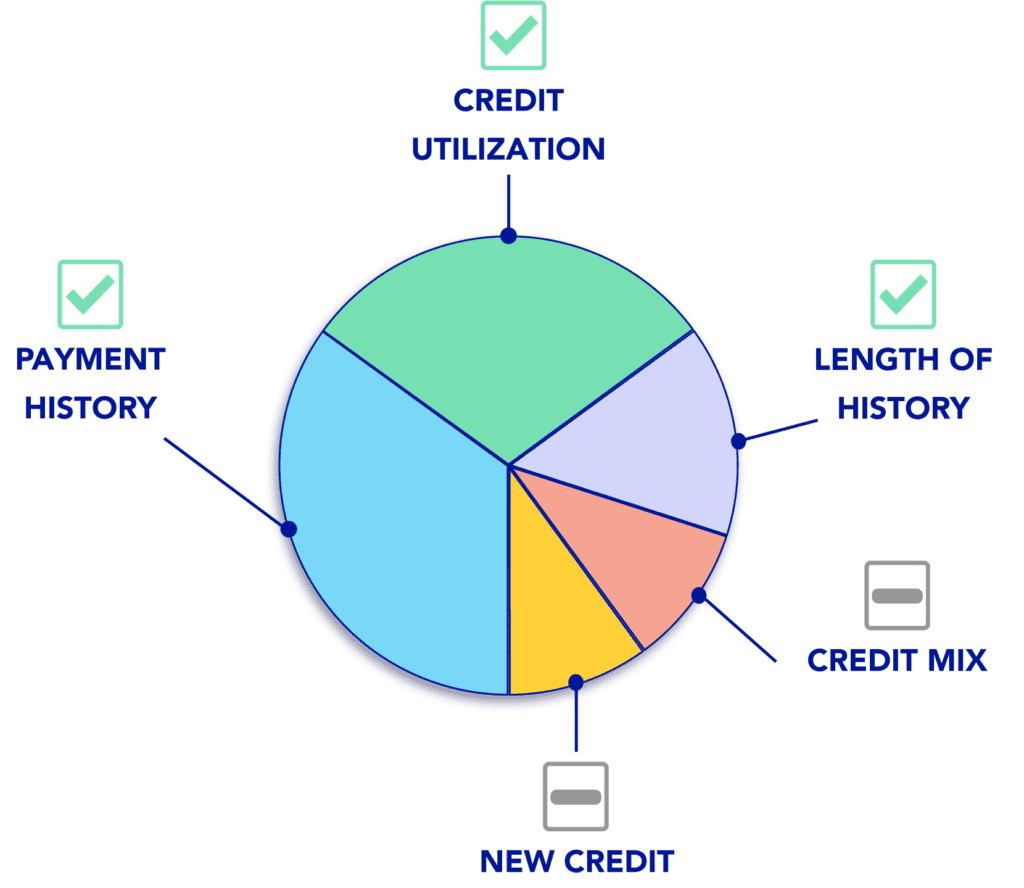

Impact your credit score

Smart credit building

The credit builder loan targets the most important factors of your credit score

Why is your credit score important?

Your score can get you...

-

A new car - auto-loan companies check your score

-

A new home - mortgage providers determine how much they'll charge you based on your credit score

-

Rental opportunites - Landlords often check credit scores

-

Employment - your future employer may check on your credit score

-

The best credit card - your score determines how expensive your monthly payments are. A better credit score can also mean better rewards