Free Hard inquiry Section 604 Dispute Letter Template

Unauthorized hard inquiries hurt your credit score. Download this free dispute template to remove them!

What is a hard inquiry?

Definition: When you apply for a loan, your lender will check your credit report. Different from a soft inquiry – which has no impact on your credit, a hard pull is used by a lender to determine if you meet their qualification criteria for a loan, such as an auto loan. Hard inquiries will temporarily hurt your credit score by a couple of points

How long do they stay on my report?

Hard inquiries fall off of your report completely after just 2.5 years. Your score will typically bounce back a few months after the inquiry appears.

What is a hard inquiry section 604 dispute letter?

Section 604 refers to the Fair Credit Reporting Act which says a hard inquiry can only be performed with a permissible purpose. This purpose typically requires explicit permission from you, the consumer. If this explicit consent was not given, the inquiry is unauthorized and can be removed by mailing a filled out copy of the above template to each of the three major credit bureaus.

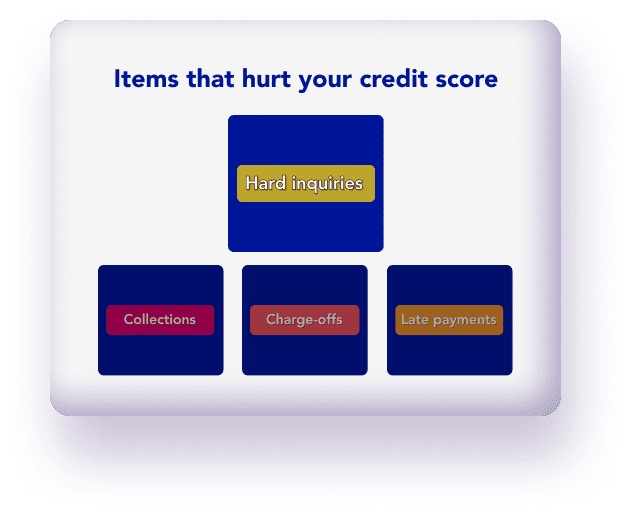

Should I care about hard inquiries?

Hard inquiries impact your credit score much less than other hurtful items such as late payments, collections, and charge-offs. It's best to prioritize these more hurtful items.

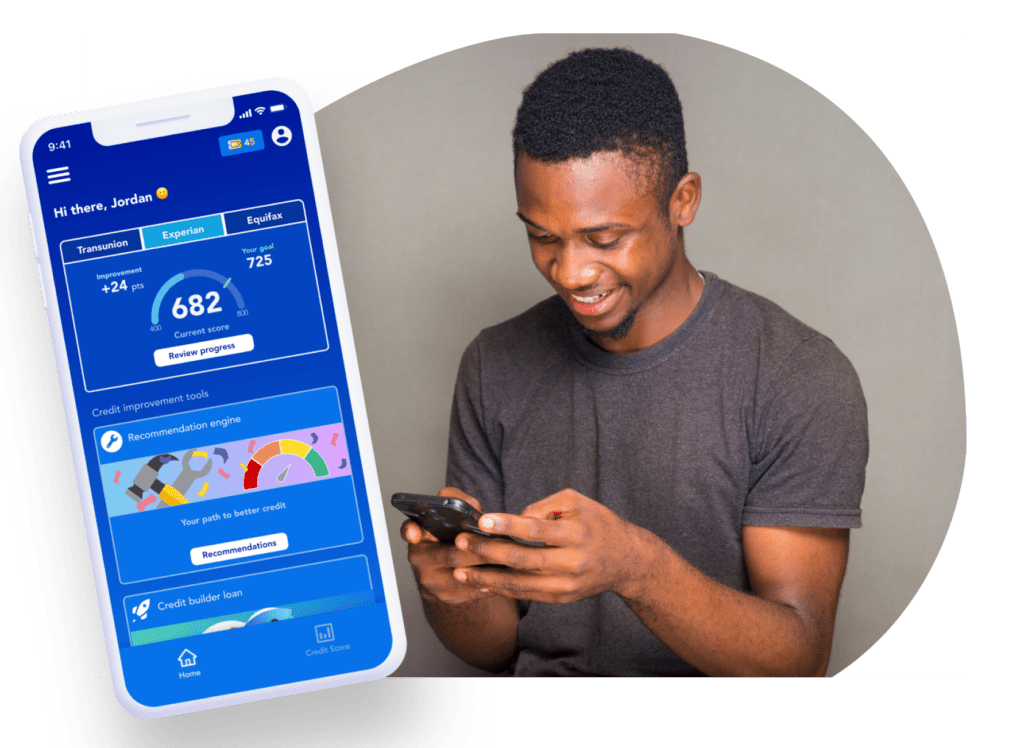

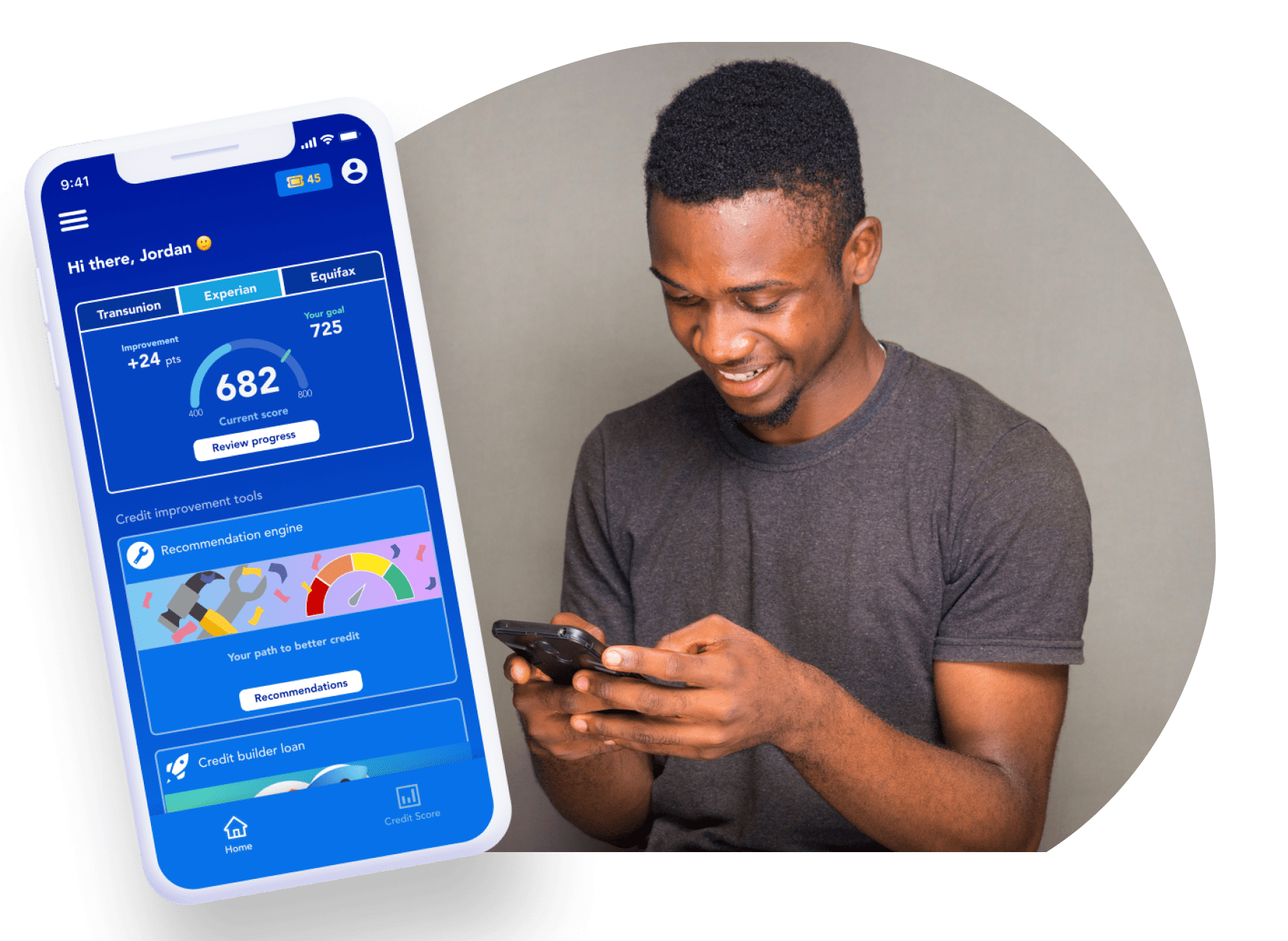

A credit specialist in your pocket

Cambio works on your credit so you don’t have to. Here’s how…

Get your free credit analysis in minutes!

We’ll do a soft pull (that doesn’t harm your score), to find areas of improvement.

All in less than 2 minutes!

Get your free credit analysis in minutes!

Get your latest credit score through a soft pull (that doesn’t harm your score), and understand how you can improve your score.

All in less than 2 minutes!

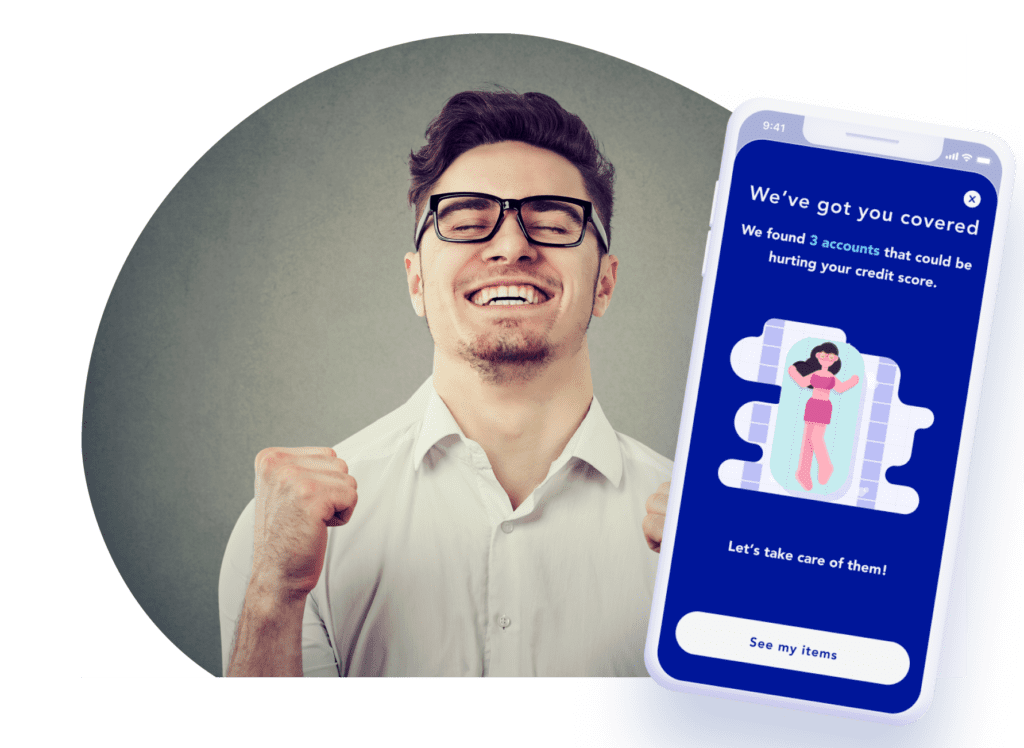

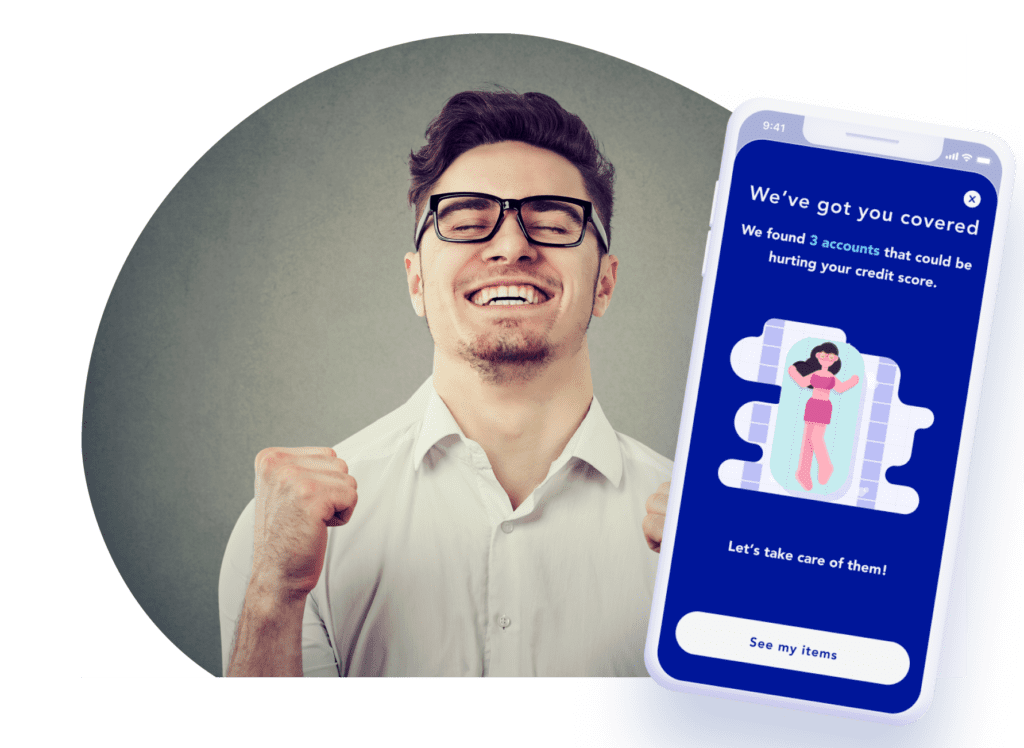

Boost your score with expert guidance

Once we know what needs work, you can use the recommended tools to boost your credit score and track your progress!

Most members start see results in less than 2 months*

Boost your score with expert guidance

Auto-identify areas that need improvement. Use the recommended tools to boost your credit score!

Track your progress. Most members start see results in less than 2 months*

Build your credit, while you save

Use Cambio Credit Builder loan to add on-time payment history (the most important factor of your credit score) and build savings!

No credit check or initial deposit needed!

Build your credit, while you save

Make monthly payments that are reported to the major credit bureaus. After 12 months, you’ll have a paid off loan and extra money in the bank!

See your score increase by as much as 50 points*, no credit check or initial deposit needed!

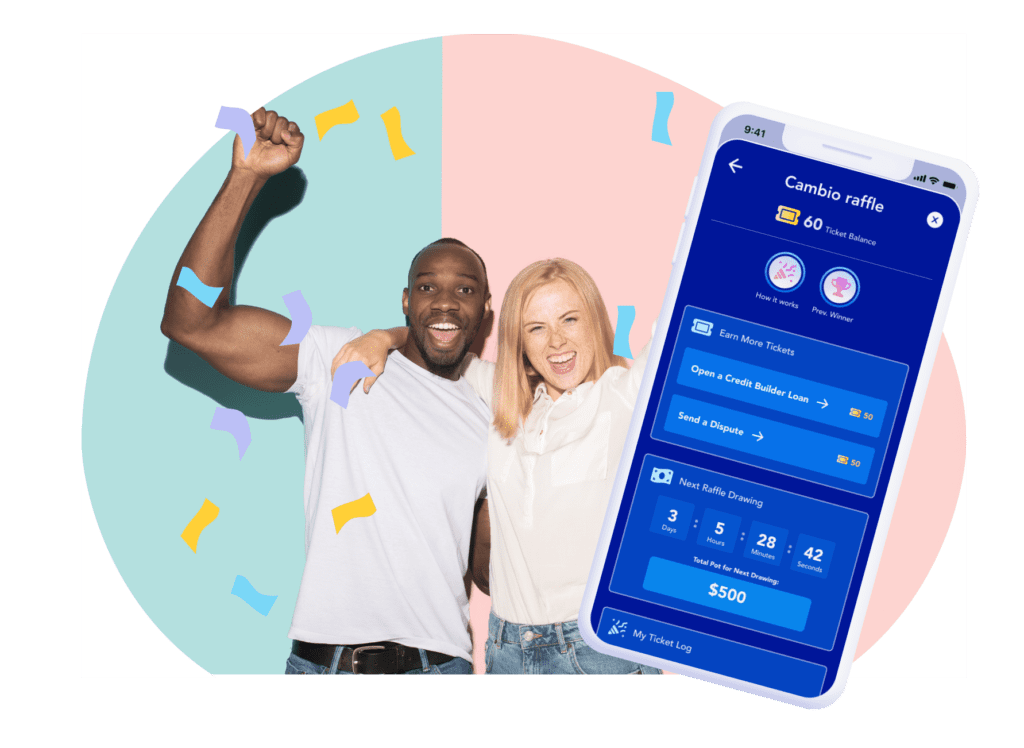

Earn rewards as you improve!

We’ll help you stay motivated as you earn chances to win cash prizes

Earn rewards as you improve!

Earn chances to win cash prizes when you take action to improve your credit score!

Refinance expensive loans and achieve your goals!

Stick to the plan to access benefits like credit builders, refinancing, and affordable lending!*

Refinance expensive loans and achieve your goals!

Stick to the plan and access benefits like credit builders, refinancing, and affordable lending!*

Try Cambio for free, no card or payment required!

Bad credit? We can help

Check out our other credit tools

Monthly analysis

Use our powerful AI to find how else you can improve your credit score each month

Remove hurtful mistakes

Grow your credit score by 100 points! Resolve items hurting your score quickly and easily

Become a credit pro

Complete daily money challenges to boost your skills and master your finances!

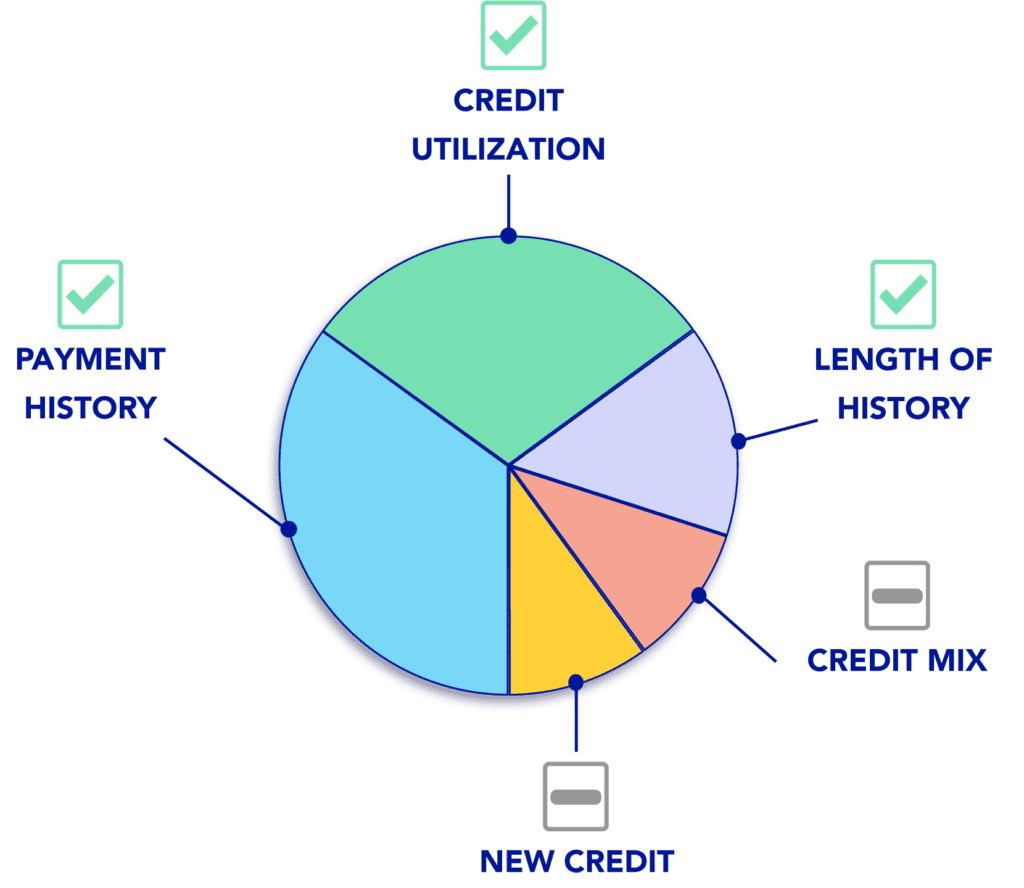

Impact your credit score

Smart credit building

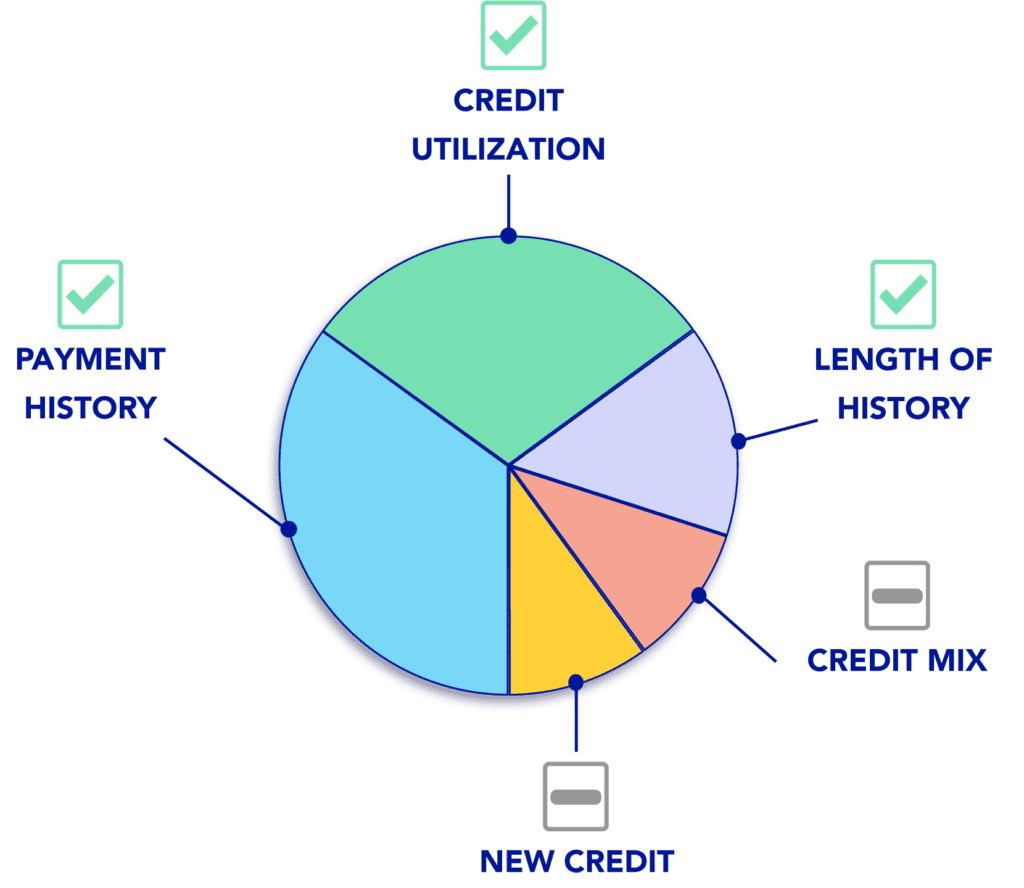

The credit builder loan targets the most important factors of your credit score

Why is your credit score important?

Your score can get you...

-

A new car - auto-loan companies check your score

-

A new home - mortgage providers determine how much they'll charge you based on your credit score

-

Rental opportunites - Landlords often check credit scores

-

Employment - your future employer may check on your credit score

-

The best credit card - your score determines how expensive your monthly payments are. A better credit score can also mean better rewards