Resolve your collections and charge-offs

Having a score above 650 is almost impossible when a collection/charge-off is on your credit report. Use our free tools to resolve them!

First, review your collection/charge-off accounts then answer the following question:

Are your collections and charge-offs accurate or inaccurate?

For INACCURATE Collections/charge-offs

Disputes can’t hurt your credit score and have the power to REMOVE the inaccurate item from your report!

Download your free dispute template now!

Disclaimer: By downloading this template you agree to receive email correspondence from Cambio Financial Health Inc. and assume full responsibility for any action you take to affect your credit report. Cambio Financial Health Inc. does not guarantee any improvements to your credit score, or derogatory item deletions.

- Heads up! This dispute template can only resolve INACCURATE collections/charge-offs. If yours are ACCURATE, continue reading.

For ACCURATE Collections/charge-offs

To resolve ACCURATE collections/Charge-offs, you can request a “Pay to delete” from your creditor. This is a tactic in which you pay 100% of the unpaid balance if creditor agrees to remove the account from your credit report

Watch the video guide to learn more >>

Download your free pay to delete template now!

Disclaimer: By downloading this template you agree to receive email correspondence from Cambio Financial Health Inc. and assume full responsibility for any action you take to affect your credit report. Cambio Financial Health Inc. does not guarantee any improvements to your credit score, or derogatory item deletions.

What is a collection?

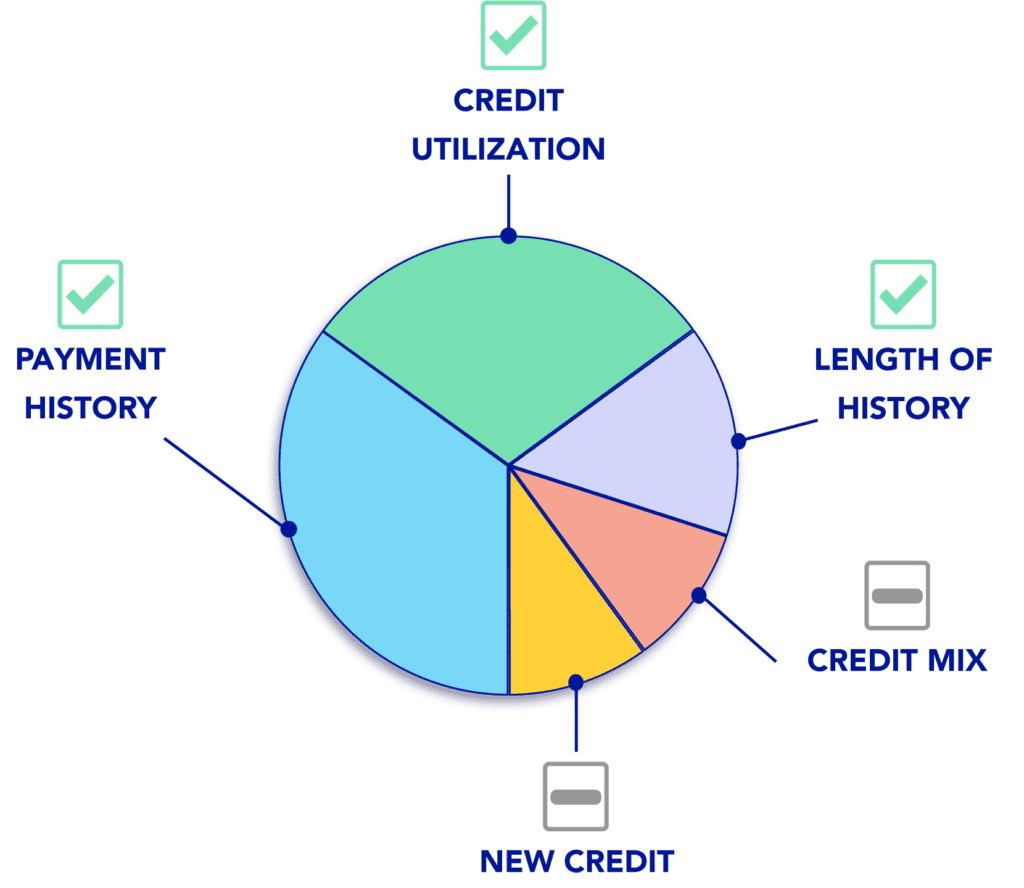

Definition: If a bill or debt is unpaid for an extended amount of time, the original creditor may sell it or have the debt serviced by a collection agency. Once this happens, the new account will be displayed on your credit report as a "Collection account". Collection accounts have a major impact on your payment history (the most important factor of your credit score) and can drop your score by as much as 100 points!

What is Charge-off?

Definition: If a bill or debt is unpaid for an extended amount of time, the creditor considers the bill or debt as a "write-off" or "charge-off". This simply means the creditor now considers that debt or bill a "loss". Once it is charged off, the creditor may or may not sell it to a collection agency. Meaning a report could contain a charge-off AND a collection for the same original debt. Similar to collection accounts, charged-off accounts have a major impact on your payment history (the most important factor of your credit score). Just one charge-off can drop your score by as much as 100 points.

How long do they stay on my report?

Both collection and charge-off accounts can remain on your credit report for up to 7.5 years.

Is it possible to remove them?

It is possible. 1/3 credit reports contain a mistake. Meaning a collection or charge-off could be on your report mistakenly. If so, a simple dispute should remove it which would cause a big increase. On the other hand, accurate charge-offs or collections can potentially be removed via a pay to delete, a tactic where you repay the debt in return for having it removed. IMPORTANT: NOT ALL CREDITORS ACCEPT PAY TO DELETE AGREEMENTS Make sure you communicate with your creditor and receive a signed letter of agreement where they agree to remove the account. Otherwise, they have no obligation to remove the hurtful charge-off/collection upon payment.

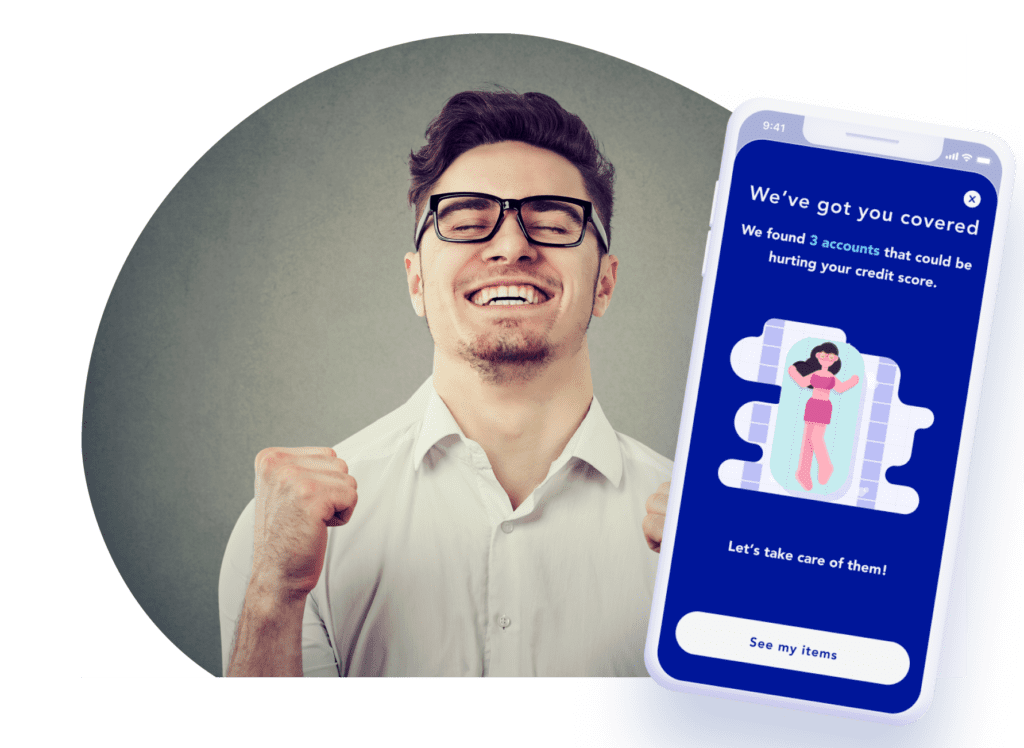

Let Cambio manage your credit

Cambio works on your credit so you don’t have to. Here’s how…

Get your free credit analysis in minutes!

We’ll do a soft pull (that doesn’t harm your score), to find areas of improvement.

All in less than 2 minutes!

Get your free credit analysis in minutes!

Get your latest credit score through a soft pull (that doesn’t harm your score), and understand how you can improve your score.

All in less than 2 minutes!

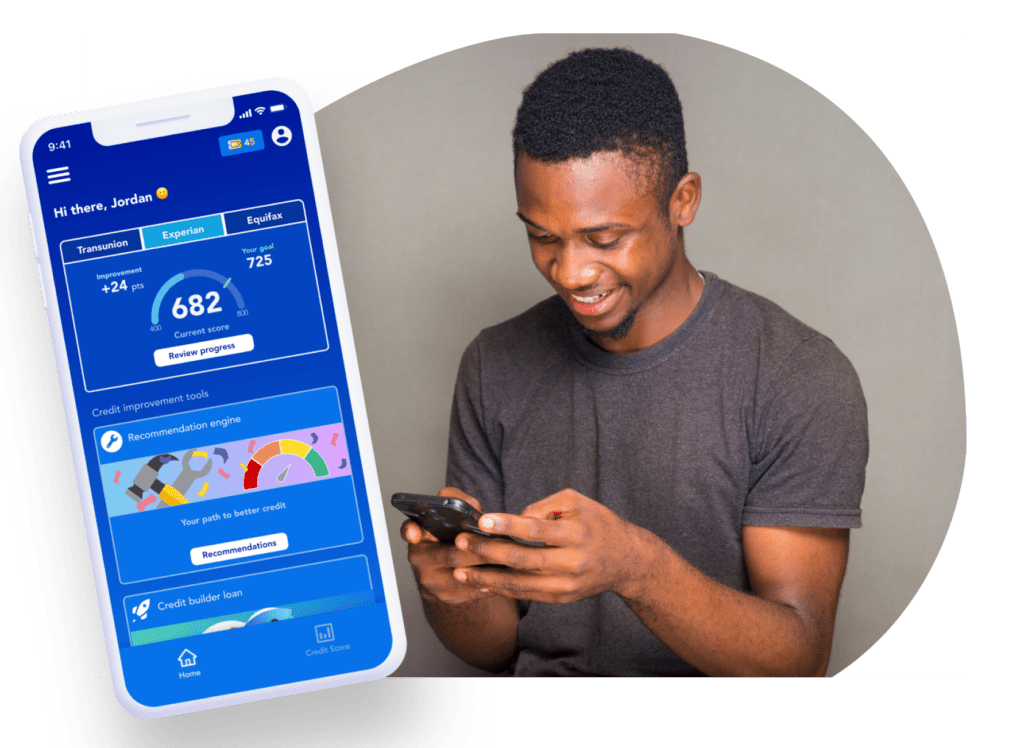

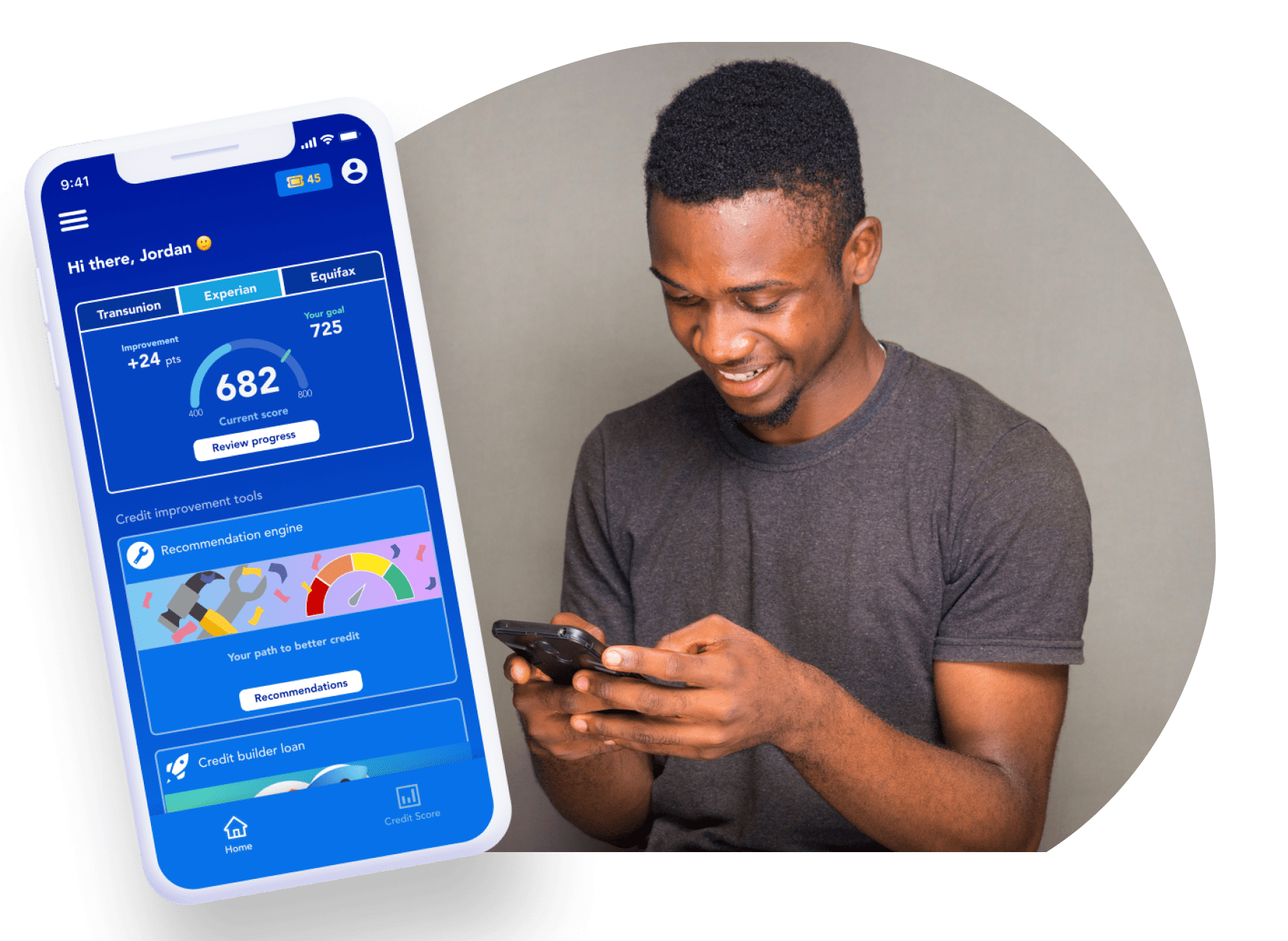

Boost your score with expert guidance

Once we know what needs work, you can use the recommended tools to boost your credit score and track your progress!

Most members start see results in less than 2 months*

Boost your score with expert guidance

Auto-identify areas that need improvement. Use the recommended tools to boost your credit score!

Track your progress. Most members start see results in less than 2 months*

Build your credit, while you save

Use Cambio Credit Builder loan to add on-time payment history (the most important factor of your credit score) and build savings!

No credit check or initial deposit needed!

Build your credit, while you save

Make monthly payments that are reported to the major credit bureaus. After 12 months, you’ll have a paid off loan and extra money in the bank!

See your score increase by as much as 50 points*, no credit check or initial deposit needed!

Earn rewards as you improve!

We’ll help you stay motivated as you earn chances to win cash prizes

Earn rewards as you improve!

Earn chances to win cash prizes when you take action to improve your credit score!

Refinance expensive loans and achieve your goals!

Stick to the plan to access benefits like credit builders, refinancing, and affordable lending!*

Refinance expensive loans and achieve your goals!

Stick to the plan and access benefits like credit builders, refinancing, and affordable lending!*

Try Cambio for free, no card or payment required!

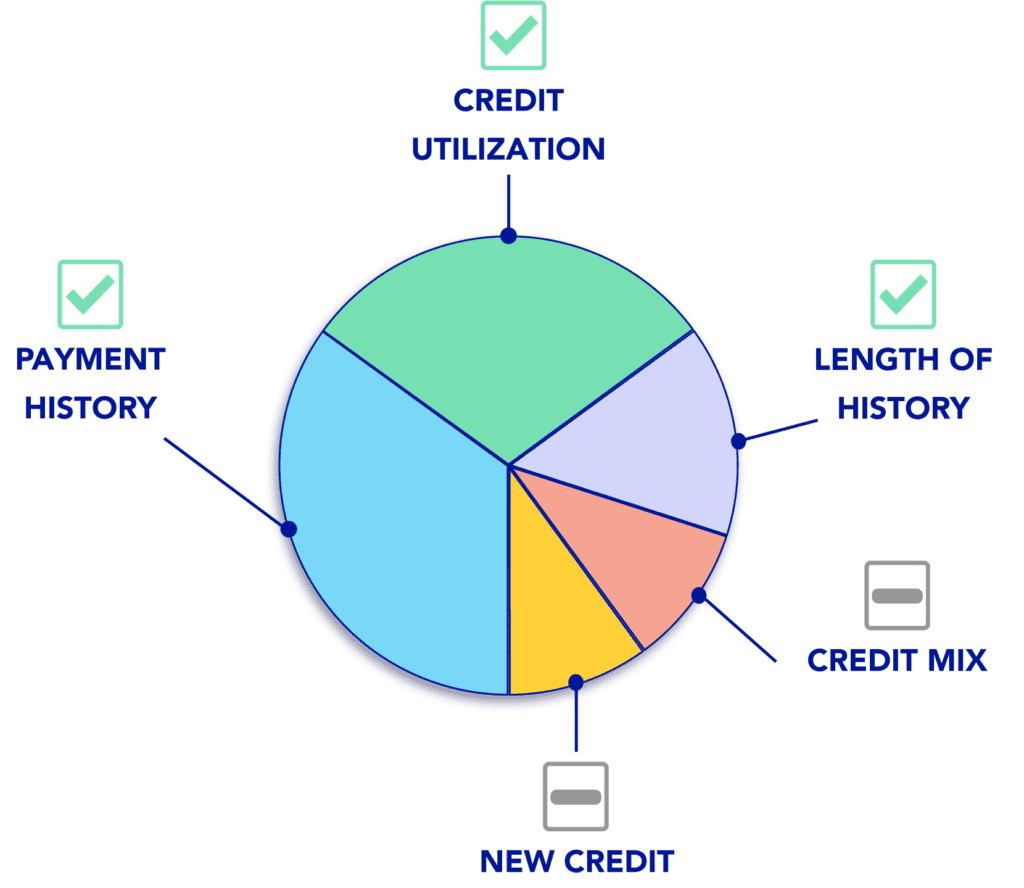

Impact your credit score

Smart credit building

The credit builder loan targets the most important factors of your credit score

Why is your credit score important?

Your score can get you...

-

A new car - auto-loan companies check your score

-

A new home - mortgage providers determine how much they'll charge you based on your credit score

-

Rental opportunites - Landlords often check credit scores

-

Employment - your future employer may check on your credit score

-

The best credit card - your score determines how expensive your monthly payments are. A better credit score can also mean better rewards