Your credit score is both incredibly important and incredibly confusing. Understanding your credit score and how it’s calculated can be the difference between living comfortably or very uncomfortably.

What is a Credit Score?

A credit score is like your report card for creditors. Previous bad marks along with good ones are there for any creditor to see but don’t worry – with credit there is no such thing as a permanent record.

The Fair Isaac Corporation built the credit scoring system we still use today and is the basis of the “FICO” report. The current iteration, FICO 8 credit scoring ranges from 300 to 850, the higher the score, the better the credit. While there are different types of credit scores, the FICO is used by lenders to determine finance rates and eligibility.

It’s a lot easier to recover low scores, than to gain traction at higher levels. When the score is a number between 620-650, it’s far easier to get to a 700 score than moving from 750-770 to 840-850.

There are three credit bureaus that report your payment history: Equifax, Experian, and Transunion. These are commonly referred to as the “major credit bureaus.”

Credit scores are the composition of weighted criteria from your credit history. Based on this score, lenders can determine risk of lending a borrower money and charge appropriate interest rates and fees.

How Is Your Credit Score Calculated?

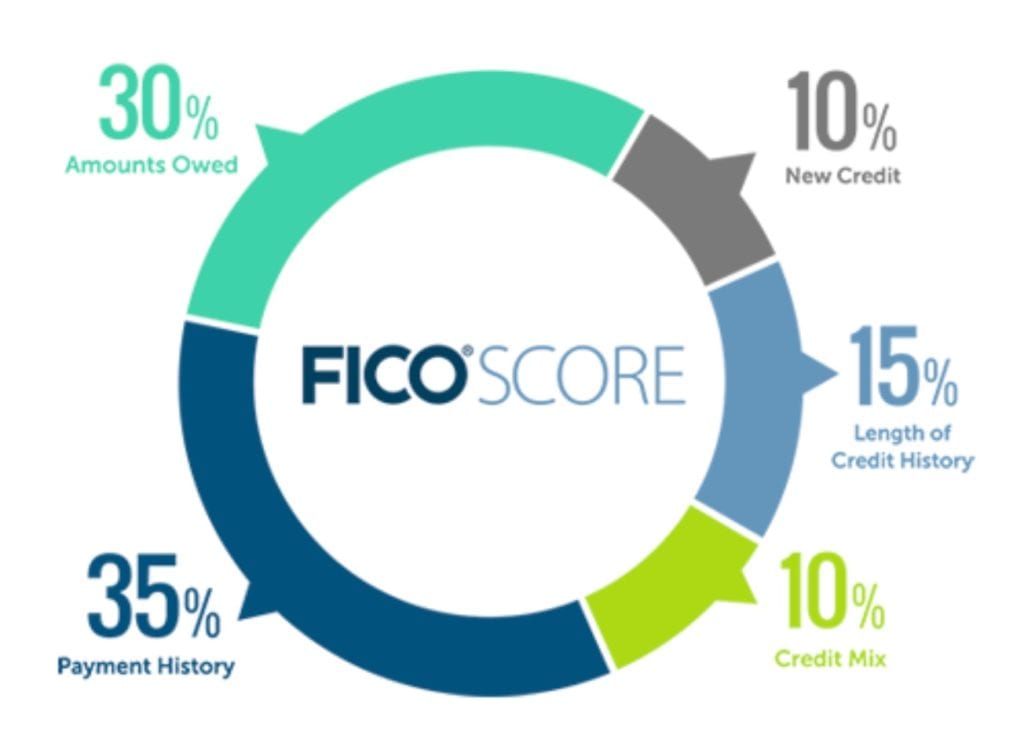

The FICO score is comprised of the following areas and weights:

- Payment History 35%

- Amounts Owed 30%

- Length of Credit History 15%

- New Credit 10%

- Credit Mix 10%

Payment History

A lender wants to know how likely you are to pay your bills on time. The best way to tell whether a borrower will return the money lent is by viewing how they have before. Accessing the information in your credit report will indicate how many on-time payments, how many late payments, and how you’ve handled those payments in the past. Past performance is not an indicator of future results

Amounts Owed

Second to payment history is the Amounts Owed section at 30% of a borrower’s score. The amounts owed section is really a percentage available credit, many call this “utilization.” For example, a credit card issuer may give you a credit limit of $5,000. If you immediately charge $3,000 you might think that’s fine because you didn’t use it all up – credit card companies want you to spend money, right? Yes and no. In fact, this looks like very risky behavior to a lender. You’re using almost everything they gave you and may not be good at managing money which means they may not get the money you’ve borrowed back. Utilization in this example is 60% of available credit.

However, let’s assume that you have another two credit cards each with $10,000 limits. Now your total available credit is $25,000. If you split your spending across those cards evenly your utilization is 20% on the smallest card limit and 10% on each of the others. This looks far less risky to a bank. You could even increase the amount borrowed to $5,000 total but as long as it was on the higher limit cards, it wouldn’t materially affect your credit score.

It’s not really the amount of money that’s owed, but rather the amount of credit a borrower utilizes that determines the this section of the score.

Length of Credit History

It’s important to know how borrowers behave over time. It wouldn’t be helpful to state that a person has a 100% on-time payment history, if they only have three months of payments. Most of this element of the score is based on an average length of time that credit accounts have appeared active on a credit bureau.

For example, if a borrower has an auto loan for which they have paid in full every month for 60 months but nothing else on their credit report it wouldn’t necessarily communicate to a lender that every debt the borrower has will be paid on-time, in full, every month. If a borrower then takes on a credit card their average length of credit history will be the average of the two. When the new credit card is added, the length of credit history would be 31 months instead of 61 months because the two lines are averaged, one with 61 months and the other with just a single month.

This is one reason why a borrower should keep their credit cards open for as long as possible even if they aren’t using them. Every month that credit card has a zero dollar credit card balance counts as another on-time payment and then of course adds to the length of credit history.

New Credit

As credit scores are all about helping banks to parse disparate pieces of information and characterize risk, new credit can be that piece of information that helps or hurts.

This is the most misunderstood aspect of the FICO score.

A “new inquiry” is when a borrower submits their full credit history in an attempt to be approved for a new loan or line of credit. Buying a house, financing a car, taking out a personal loan, or applying for a new credit card are all examples of applying for credit and incurring a new inquiry. However, even if you are not approved for credit, this penalty (up to 10%) will last at least 90 days and potentially up to 24 months.

Many confuse “checking your credit score” as incurring this penalty. There is no penalty for making an inquiry into your credit files if there’s no credit being applied for.

Further, this misunderstood penalty keeps many people from applying for credit on a regular basis, but its impact is truly very limited so long as there is at least 90 days between applications.

Credit Mix

Lenders want to see a mix of payment history that demonstrate a person is managing their money across a variety of accounts, some with fixed payments, others with revolving accounts like credit cards.

This is a small portion of the score because not everything applies to all borrowers. For example, In New York City, it may be unlikely that a borrower will have a mortgage due to the high cost of real estate, they may not need a car either. They simply won’t have those types of loans on their file but it would be unfair to significantly penalize them for this.

If, however, a person only has credit cards on their report, that could be a sign of trouble as they have simply taken out many new lines of credit for nefarious purposes.

Why Is It Important?

When you understand your credit score, you can make better decisions. By better managing your credit, you can secure a higher score and in so doing lower your borrowing costs.

For example, if a 670 credit score can secure a 30-year mortgage on a $150,000 property at 4.5% interest, they will pay $123,000 in interest over the life of that loan, almost equal to the amount borrowed. If instead, that person has a 770 credit score on the same home and secure a 3% interest rate, they will pay just $77,000 in interest saving them $50,000.

Lower interest rates have another interesting advantage. In addition to saving money over the life of the loan, they also lower the payment amount. In the example above, the 670 credit score would pay $760/month while the 770 score would pay $632/month. That monthly difference of $128 could mean the borrower saves the money, pays their insurance or offsets their cell phone bill, increasing their wealth.

They could also buy more house for the same money. Assuming the person is the same (same job, costs, commitments, etc.) and can only afford a house payment under $770/month, they can have a $150,000 house if their credit score is 670, or $181,000 house with a 770 score.

Monitoring credit can also catch and prevent identity theft, a potentially very costly problem.

Conclusion

The best way to improve your credit score is to understand it. This guide is one way to do so, but Cambio has other options as well. Check out more articles about credit or contact us today to see how we can help you.

Pingback: FICO score: top things you must know - Cambio

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point.

You clearly know what youre talking about, why throw away your intelligence on just

posting videos to your weblog when you could be giving us something informative

to read?

Good info. Lucky me I found your blog by chance (stumbleupon).

I have book-marked it for later!

It’s awesome to pay a quick visit this web site and reading the views of all friends about this piece of writing,

while I am also eager of getting knowledge.

I’m not that much of a internet reader to be honest

but your blogs really nice, keep it up! I’ll go ahead and

bookmark your site to come back later. Many thanks