No credit, no problem? Actually, it is a problem. Here’s why you should avoid no-credit-check personal loans.

How Credit Works

Credit and credit scores are one of the most confusing things for most adults to understand. It’s incredibly important to know how to use credit and avoid trouble – it can mean the difference between being able to get the home you want and the job you need.

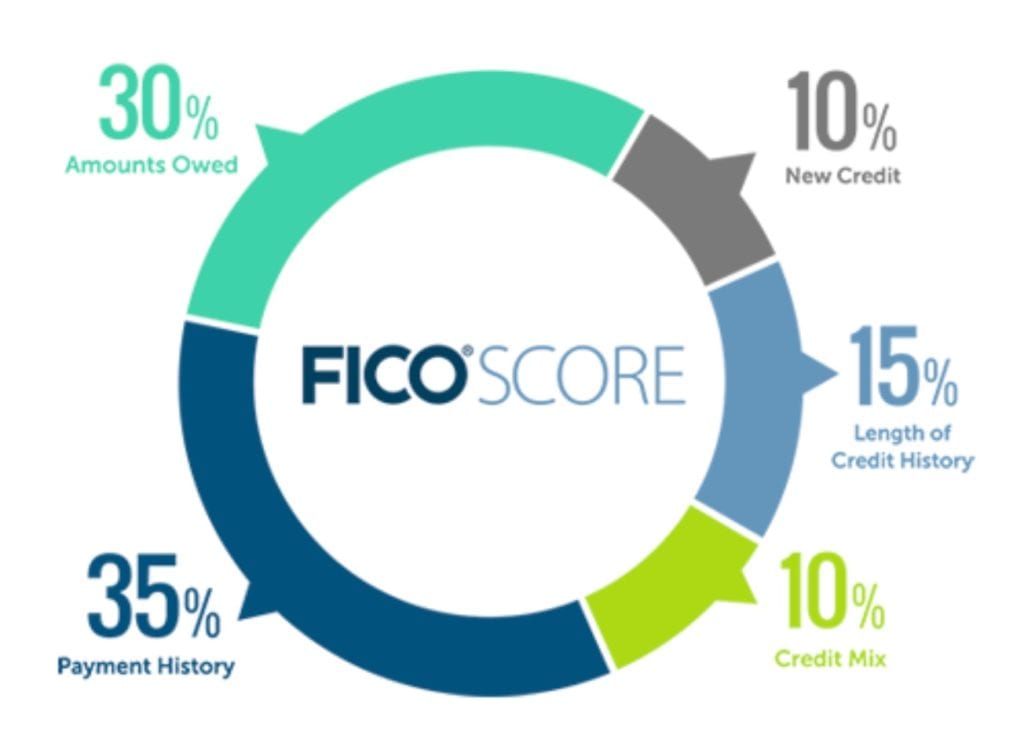

In essence, credit scores run between 350 and 850, the higher the score, the better the credit. Paying bills on time, maintaining low balances, applying for a few new credit lines (credit inquiries), and having a good mix of credit all contribute to improving your credit score.

Everyone starts out with a reasonable credit score usually in the range of 650-720, as there is no reason to assume a new borrower won’t properly manage their credit. However, with limited credit history it can be difficult to obtain an initial loan to demonstrate credit worthiness.

Understanding how your (FICO) credit score is created and what actions positively and negatively affect it can help borrowers to be better informed, garner better credit scores, and become more financially stable.

Keeping new inquiries for credit to no more than one in a 90-day period and two or less in a 24-month period will offer an optimal score. Add to that a revolving credit (credit cards) utilization rate below 10%, payment history of five years, and no derogatory marks will ensure borrowers have the best possible credit.

No-Credit-Check Personal Loans and Financing

Famously, “Buy Here, Pay Here” car lots are a common place to find “no credit financing.” Often, these types of auto loans appeal to two different kinds of buyers, those with poor credit and those who simply don’t understand the process and are not educated about no credit financing.

No credit financing means that rates are non-competitive with what buyers may be able to find elsewhere, and have all of the perils of negatively affecting a buyer’s credit report and none of the positives.

Likewise, Payday Loan lenders can charge exorbitantly high interest rates that quickly eclipse the original loan amount. For example, in Indiana, a state that has made progress toward limiting the amount of interest that can be charged for Payday loans, APRs still legally reach 390%.

As states and local governments have begun to crack down on these heavy usury loans, online lenders who operate outside of those bounds have taken a similar approach:

“The internet is teeming with lenders who promise immediate cash but at rates that can exceed 1000% APR on loans that automatically renew (and recharge you a high fee) every few weeks.” says attorney Vess A Miller of Cohen & Malad.

Creditors Still Have Rights to Affect Your Credit Score Negatively

Looking past the seedy nature of loans made without credit checks, lenders still have all the rights of standard lenders. They have rights to recover their debt by any means necessary just as any creditor would.

For example, if a car buyer stops paying their no credit check loan, the lender can still come to reclaim their vehicle, for which the loan remains in effect and the car is repossessed.

Loans with no credit check can be turned over to collections, something that often happens in the case of apartment complexes where there has been damage or a disputed final amount. Collections will negatively affect a borrower’s credit score.

No Upside for Consumers

Consumers who pay their loans on time, every month, and pay in full will not receive any of the benefits of their good repayment history with these installment loans either. When a loan is offered without a credit check, even the best borrowers won’t create good credit scores without loans that require credit checks.

Sometimes consumers can be confused by soft inquiries run for personal loans that are not the same as full credit checks. These are called “soft credit inquiries” and really just verify the person’s identity and confirm no public information such as discharged bank accounts or bankruptcies.

Why You Should Avoid No-Credit-Check Personal Loans

Any personal loan that has all of the requirements of repayment and penalties for non-payment should be avoided. Consumers will not receive any of the positives that come from taking a loan and repaying it on time and as scheduled.

However, if they are late with their payments, do not pay in full, or otherwise violate the terms of their loan, they face all of the consequences of their actions.

Additionally, borrowers of no credit loans pay higher rates of interest than are otherwise available on the market. A personal loan from a bank or credit union should have a rate in excess of the US Prime rate, which has not exceeded 10% in decades. Auto loans from Buy Here, Pay Here lots typically exceed 15%, and Payday loans are dramatically higher than that. Online lenders operate in an unregulated environment which can make even those rates seem like a favor.

If you are ever unsure if you have applied for a loan that will count towards your credit score, each year you can check your credit for free. Many services also offer free credit monitoring services which will instantly contact customers (notification, text message, email, or even a phone call) when a new inquiry has been made. If no such contact arrives, your credit has not been run.

If you have limited access to credit and would not qualify for a traditional loan with reasonable and regulated interest rates, consider adding a co-signer to your note. This will allow you access to lower interest rates, reasonable terms, and will help you build your credit in the process.

Conclusion

Credit check personal loans ensure that the note is operating within a regulated environment built for the protection of both the borrower and the lender. This will ensure interest rates are offered at reasonable levels, loans are repaid within a normalized period of time, and borrowers that repay their loans properly will be able to improve their credit with each payment.

Indeed availing for a fast personal loan can be a good way to find solutions to financial needs that may unexpectedly come your way. But with the many uses you can do with these type of loan, it can be a burden if you don’t plan ahead for its repayment. Even if you do have a bad credit, you can still avail for these loans and you should treat this opportunity to straighten up your credit records and prove to the lender that you can be trusted.