Navigating credit reports can really make your head spin.

With inconsistent reporting schedules, constant changes in your balances, and potential policy shifts over time, it’s so easy to lose your bearings on who’s reporting what info and when.

As a Capital One customer, knowledge is power when it comes to your financial health. Gaining an understanding of their reporting timeline will not only boost your credit score but help you to build a long-lasting positive relationship with your lender.

This guide will help you with that. We’ll map out exactly when and how Capital One sends your account updates to the big three credit bureaus—Equifax, Experian, and TransUnion.

We’ll share how you can figure out when they’ll report to credit bureaus, where they pull your data from, and who they share it with, returning the power over your finances to you.

By shedding light on Capital One’s whole credit reporting process, you’ll be able to keep close tabs on your account so you can spot any errors ASAP and keep your credit profile in tip-top shape.

Let’s get started.

What is credit reporting?

Credit reporting is a big deal when managing your money moves.

In short, it involves lenders like Capital One passing info about your credit activity along to the ‘big three’ credit bureaus—Equifax, Experian, and TransUnion. We’re talking payment history, current balances, credit limits, and account statuses.

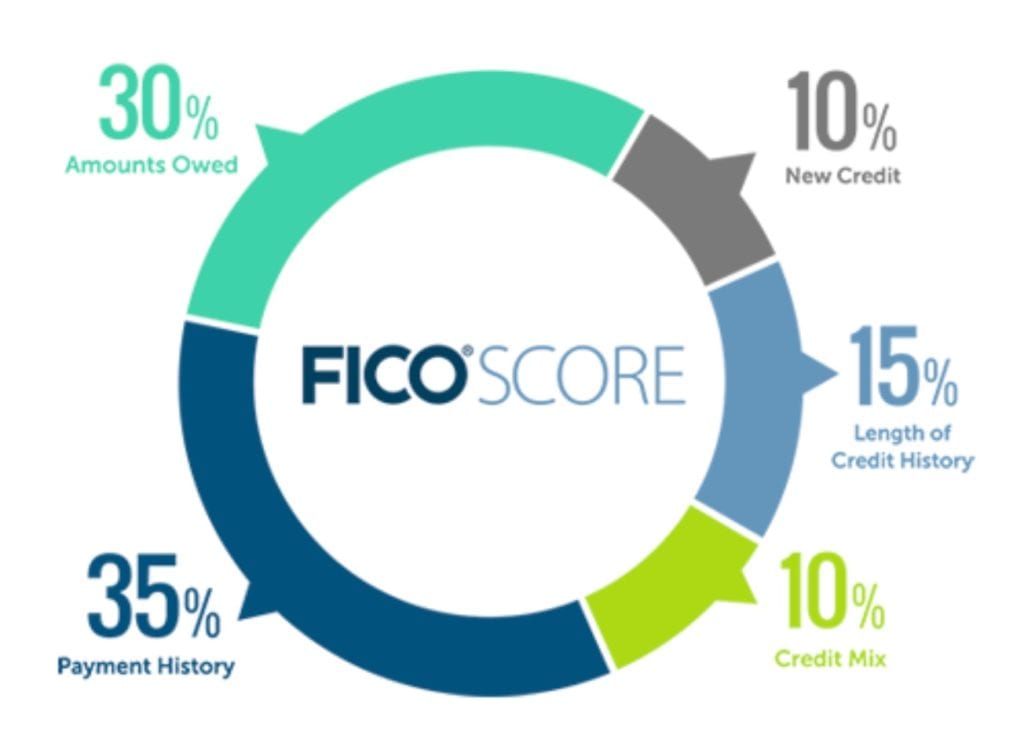

Now, the credit bureaus take this data and whip up a credit report that lays out your financial history. Credit scores are calculated based on these reports, and those scores are what lenders check to judge if you’re trustworthy borrowing-wise.

Because of this, the accuracy of your credit report depends a lot on lenders regularly reporting the correct info. If they slip up, errors get made in your report, which can tank your credit score and cause problems later down the road when you need to prove your financial responsibility.

How often does Capital One report to credit bureaus?

According to Capital One themselves, lenders report new info to the big three credit bureaus every 30-45 days on average, so you’ll likely see changes reflected in your report once a month.

The exact dates will vary, of course, because lenders all have their own reporting schedules and policies.

When does Capital One report to the credit bureau?

When Capital One clues in the bureaus can depend on a few things.

For instance, when you make credit card payments, the new balance info is typically passed along two or three days after the payment hits your account.

Another key thing is how account types can affect reporting timelines. For example, credit card action is often reported more frequently than auto loans or mortgages because it fluctuates rather than remaining fixed.

That’s why staying on top of payments across all of your accounts is important, not just for your credit health but to make sure that your report shows your latest financial behaviors.

What day of the month does Capital One report to the Credit Bureau?

This is a bit of a trick question because there’s actually no set date each month for your scores to update.

It could probably be figured out with some long-term monitoring and a watertight payment schedule. Still, it all really depends on Capital One’s reporting timeline, when the bureaus update their reports, and when scoring companies crunch those reports into new scores.

How does rapid rescoring affect my Capital One report?

Every now and then, you might want to fast-track your score update. There’s a technique called rapid rescoring that lenders can pull to add new repayment stats to your report quickly. It’s usually applied to home loans but can be applied elsewhere, too.

You’ll need to ask your lender if they can apply rapid rescoring if you want to utilize it. Without asking your lender, you can expect your score refresh timeline to stay the same as usual, even if you’ve just crushed some debts.

Capital One has been known to accept rapid rescore requests for credit accounts, but it’s worth bearing in mind that they don’t have to accept, so don’t rely on a ‘yes’ if you’re looking for a boost.

How to monitor your Capital One account

Keeping up with your Capital One account is vital for credit success. By staying current on your activity, you’re in the driver’s seat when it comes to building your credit status, catching any mix-ups, and reacting to changes fast.

There are some real benefits to monitoring your account regularly.

For one, you can quickly spot any changes or errors before they impact your credit, plus seeing your payment history and credit use will help you game plan to boost your score. And if identity theft or fraud ever strikes, catching it early can limit the damage big time.

Here are some pro tips to help you keep an eye on your Capital One account:

👩💻 Use Capital One’s online banking tools to check your balance, payment status, and recent transactions regularly. Watch out for anything weird or suspicious that doesn’t jive with your spending. Checking often helps you identify issues quickly.

📱 Use a credit monitoring app such as Cambio to check over your credit score and what it’s made up of and see what factors are impacting it month-to-month.

📨 Request your free annual credit reports from all of the big three bureaus–Equifax, Experian, and TransUnion. Compare the reports and confirm your personal info is correct across the board to help identify any errors or fraudulent accounts.

Knowing Capital One’s reporting timeline helps you keep your report shipshape. Staying on top of your credit means less stress and more financial freedom down the road!

Staying proactive about your credit management ensures less stress and more financial freedom down the road!

Tips for maintaining a healthy credit relationship with Capital One

Having a healthy credit relationship with Capital One or any lender can significantly boost your credit score and overall creditworthiness.

Here are a few essential practices that can foster a great relationship with your lender:

⌚ Timely Payments: The first rule of good credit health is making all your payments on time, as payment history is a major factor in your credit score. Late or missed payments could lead to negative reporting.

⬇️ Maintain Low Credit Utilization: Try to keep your credit utilization ratio (your total credit balance versus your total credit limit) below 30%. High utilization can impact your credit score negatively.

🔑 Routine Account Review: Regularly review your Capital One account details to identify any unauthorized transactions or errors and dispute them promptly. This also allows you to stay aware of your spending and payment habits and take action when necessary.

Consequences of Negative Reporting by Capital One

Negative reporting by Capital One can really drag down your credit standing. Here are some types of negative marks to watch out for:

⌛ Late payments: Paying bills 30, 60, or 90 days late can lead to adverse reporting and score drops. Setting up a regular payment schedule will avoid this.

🚨 Maxed-out credit: High utilization close to your limit looks risky and can prompt negative info; generally speaking, it’s best to keep credit usage below 30%.

🍃 Missed payments: Forgetting a payment entirely is bad news. Sometimes, you can ask lenders to forgo this one by sending them a goodwill letter–click here for a template.

🫙 Bankruptcy/foreclosure: If you’re already at this point, we know it’s unavoidable. However, these major defaults lead to serious negative reporting that stays for up to 7 years.

💸 Collections: Unpaid bills sent to collections generate lousy credit, so address debts as soon as you know about them to avoid this.

👎🏻 Tax liens: Failing to pay the IRS results in damaging adverse reporting as well.

The main consequence of any negative reporting by Capital One is a lower credit score, which reduces your chances of good loan/card terms and affects your financial options.

Negative marks stay on your credit report for up to 7 years.

Recovering from a bad credit report is a drag and can really slow down bouncing back credit-wise, and ultimately, negative reporting will shape how lenders view your trustworthiness.

How to dispute errors on your credit report

If you notice any errors or wrong info on your credit report, it’s crucial to take action fast to save yourself from getting a bad rep with lenders.

To file a dispute, follow these steps:

📝 Write a dispute letter: Clearly explain the discrepancies you see in your report. Include your personal deets and back up your claim with related docs. You can use our template to help you get started on this.

📤 Send the letter to the credit bureau: The big three bureaus—Equifax, Experian, and TransUnion—each have processes for disputes. Check their websites for their processes before you send anything off.

🗣️ Let the lender know: Clue in the associated lender about the dispute so they can update their records accordingly.

Remember, ensuring your credit reports are accurate is super important for your financial health and trustworthiness, but you shouldn’t dispute anything you know to be correct.

Gain control of your credit with Cambio Money

Staying on top of your Capital One account can really boost your credit health.

You’ll need to be proactive in keeping close tabs on your account, making bill payments on time, keeping credit use low, and disputing any errors fast to build solid relationships. All of these actions come together to paint your financial health picture.

We know that riding the financial waves isn’t always smooth sailing, and ticking all the boxes here takes an investment of time, education, and hard work.

That’s where Cambio Money comes in.

We’re your personal credit expert, with an all-in-one AI platform designed to get your score on track, protect your identity, tackle collections debt, and guide you towards financial recovery in a few taps.

Your financial freedom is within reach, and Cambio’s got the tools to help you grab it. Download our app and start achieving your money goals right away!