Getting on the road to financial success is within your reach. And it starts with credit control.

As a crucial aspect of managing personal finances, it helps individuals avoid financial difficulties associated with debt. This blog post will explore what credit control is, why it’s important for consumers, and how individuals can implement effective practices to manage their finances.

What is credit control?

Don’t feel bad. You are not alone. All of us have some bad money habits. Recognizing them and doing something about them will change your life. Managing good credit involves establishing policies, procedures, and systems to monitor and manage the credit risk exposure of individuals who borrow money. If you’re among the 58% of Americans without a solid savings account or your personal finances are otherwise pinched, now’s a good time to evaluate how to manage your money.

Why is credit control important for consumers?

Firstly, it helps individuals manage their finances by ensuring they borrow only what they can afford to repay. With todays high interest rate environment, living without credit control can cause fees to skyrocket. Following these steps can help avoid debt financial difficulties, such as late payment fees, interest charges, and legal action. Secondly, credit control helps consumers maintain a good credit rating. A good credit rating is essential for obtaining credit in the future, such as a mortgage or a car loan. By establishing effective credit control practices, individuals can demonstrate their creditworthiness to lenders and creditors, which can help secure future credit.

Finally, credit control is important for consumers looking to improve their personal finances. By establishing effective credit control practices, individuals can reduce their debt, increase their savings, and achieve their financial goals.

Here are five easy steps to help you get control of your personal finances. Once you gain control, you simply have to maintain some of the tasks so you can stay in control.

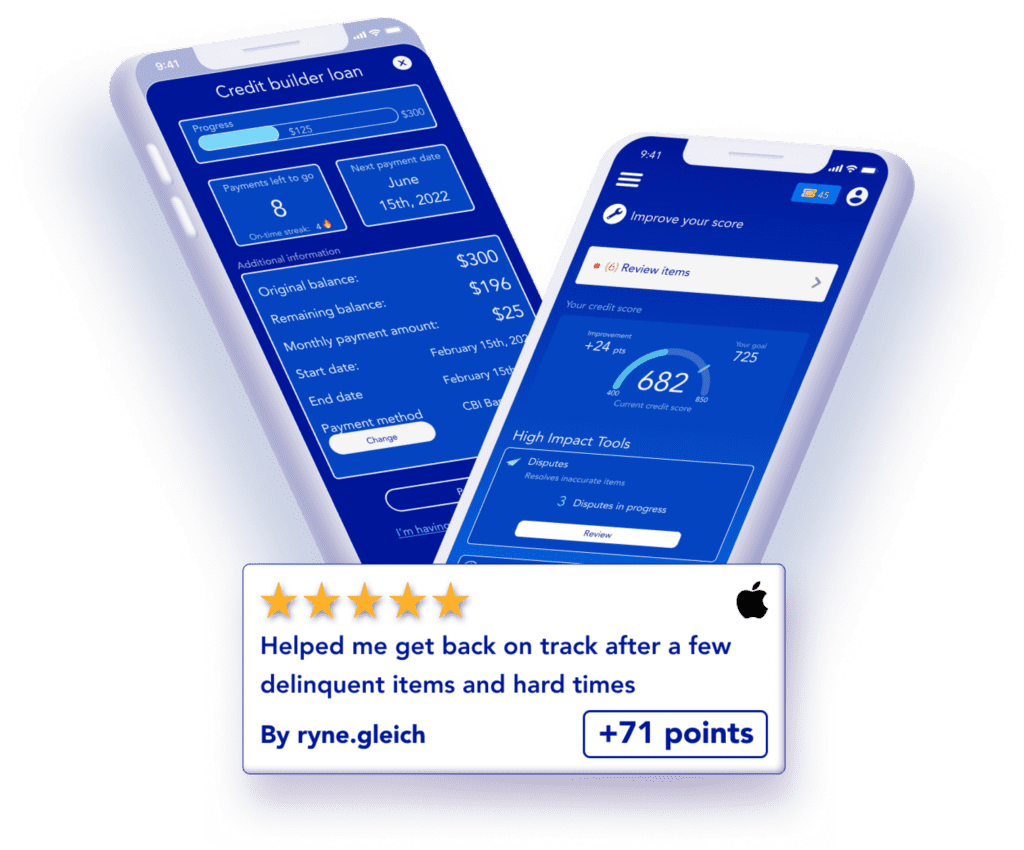

Credit score holding you back?

Download Cambio, a credit specialist in your pocket

5 Steps To Credit Control

Implementing effective credit control practices for consumers involves several key steps. These include:

1.) Establish a budget

Establishing a budget is the first step in implementing effective credit control practices. This involves setting out the income and expenses of the household and determining how much can be allocated toward debt repayment. A budget can help individuals to identify areas where they can reduce expenses and increase savings, which can be used to pay down debt.

2.) Monitor credit reports

Before borrowing money, it is important to monitor credit reports to assess creditworthiness. This involves reviewing credit history, payment behavior, and other factors that may impact the ability to obtain credit. Credit reports can be obtained for free from credit bureaus and should be reviewed regularly to ensure that they are accurate and up to date.

3.) Limit borrowing to control credit

Get a plan in place. The high interest rate of loans can eat into your savings. Consequently, when you take on multiple loans this also negatively affects your credit score, making it harder for you to build credit. Being dependent on credit cards or taking on too much debt can hamper your budget and become a financial burden. This involves establishing a borrowing limit that reflects the ability to repay the debt and avoiding borrowing beyond this limit.

4.) Make timely payments and goals

To maintain good credit, making timely payment is important. That means paying bills on time each month and avoiding late or missed payments. If you want to achieve more, setting goals is the way to do it. Setting goals gives you clarity. It will help you to stop squandering money and save more. It will inspire you to open yourself up to new possibilities.

5.) Seek help if needed

Seek expert advice. If an individual struggles to manage their debt, it is important to seek help. This may involve speaking with a financial advisor, seeking debt counseling, or entering into a debt management plan. Being informed will help you make better financial decisions.

Credit control is an essential aspect of managing personal finances and can help individuals avoid financial difficulties associated with debt. By establishing effective credit control practices, consumers can manage their debt, maintain a good finance rating, and achieve their financial goals.

Put bad credit behind you and start improving your credit score today for free with Cambio.