Remove Medicredit Inc. From Your Credit Report In 3 Simple Steps

Do you have unpaid bills that have gone to collections? If so, you are in the company of over 60 million other Americans with the

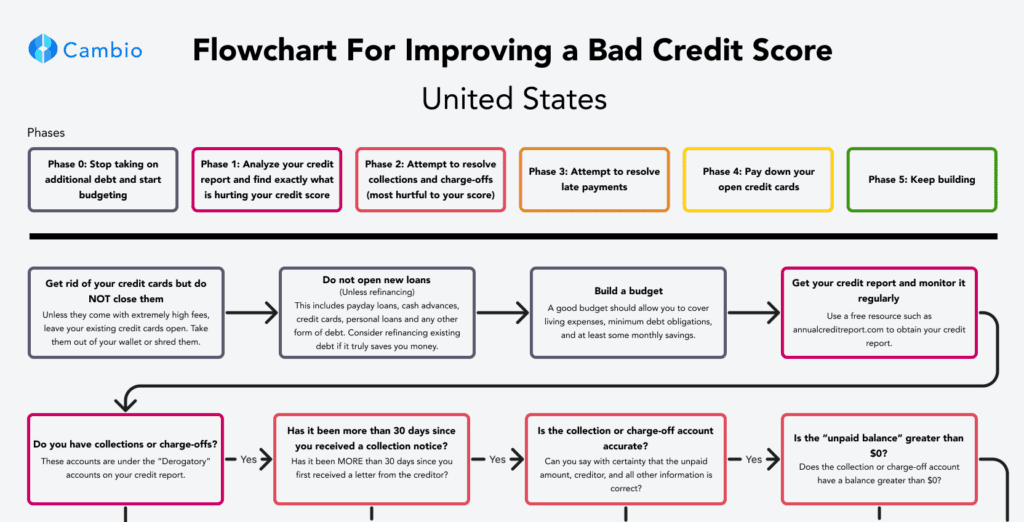

Everything you need to jumpstart your credit score and achieve your goals

Check out our most used resource!

These accounts have the largest impact on your credit score. Use Cambio's free tools to resolve them

Even one late payment can have a large impact on your credit score. If yours are accurate, use our Goodwill template to resolve them!

Hard inquiries have a lower impact on your credit score. Learn more about how they impact you and possible ways to resolve them.

Generate your free hard inquiry dispute template now!

Takes less than 2 minutes

Generate your free collections dispute template now!

Takes less than 5 minutes

Free templates and step by step instructions

Free guide and template! Learn how to resolve your collection accounts

Takes less than 5 minutes

Works best for accounts with only a few late payments

For collection accounts that have appeared on your credit report recently (Within the last 30 days)

Get answers from Cambio experts or members who have been in your shoes.

Stay up to date on all things Cambio with product updates, announcements and more!

Vent to other Cambio members working on improving their credit scores

Do you have unpaid bills that have gone to collections? If so, you are in the company of over 60 million other Americans with the

Do you qualify for a home office deduction? If so, you’ll want to read our guide with easy to understand Instructions for the IRS Form

Your credit score will be a major decision factor when you want to rent an apartment. Landlords or apartment complex managers always check applicants’ credit

Reprise Financial is a company that has gotten a lot of attention recently, as a financial service that helps people get personal loans. The company,

Eviction is a terrible challenge to face. Not only because you lose your home, but because an eviction affects your credit for years to come.

Coffee Break Loans is a company that went viral on TikTok for promising an easy way to get a loan of $1 – 5000. The

Are you receiving repetitive calls from Halsted Financial Services at odd times? Or do you receive texts from them, claiming you owe a debt? Imagine

If you have noticed an account with Sequium Asset Solutions on your credit report, you might also notice that this has negatively affected your credit

If you’ve seen FBCS on your credit report and wondered what this company was, or why your score tanked when FBCS appeared, read on. We’re