Your Complete Guide to Delete Monarch Recovery Collections

Debt dragging you down? It happens to so many of us. And debt collectors like Monarch Recovery Management often make a bad situation worse with

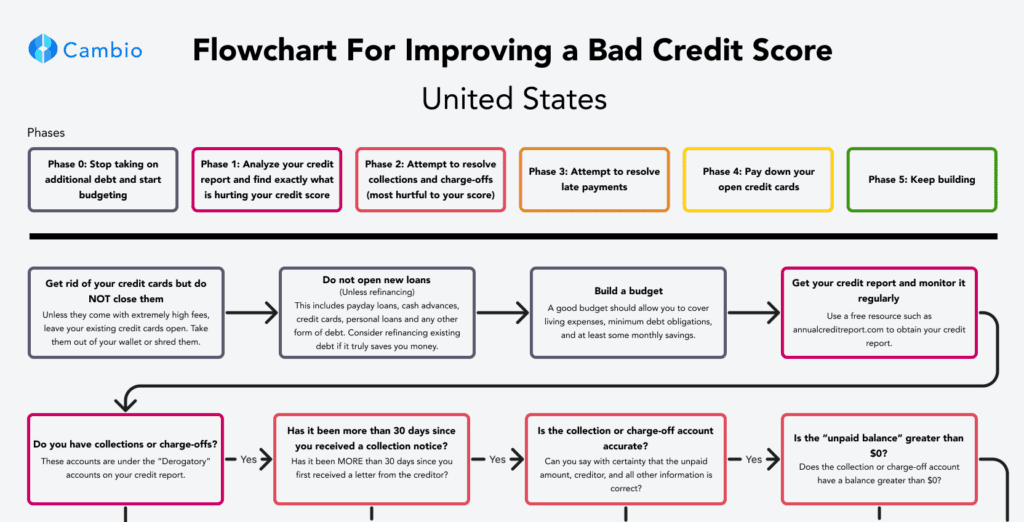

Everything you need to jumpstart your credit score and achieve your goals

Check out our most used resource!

These accounts have the largest impact on your credit score. Use Cambio's free tools to resolve them

Even one late payment can have a large impact on your credit score. If yours are accurate, use our Goodwill template to resolve them!

Hard inquiries have a lower impact on your credit score. Learn more about how they impact you and possible ways to resolve them.

Generate your free hard inquiry dispute template now!

Takes less than 2 minutes

Generate your free collections dispute template now!

Takes less than 5 minutes

Free templates and step by step instructions

Free guide and template! Learn how to resolve your collection accounts

Takes less than 5 minutes

Works best for accounts with only a few late payments

For collection accounts that have appeared on your credit report recently (Within the last 30 days)

Get answers from Cambio experts or members who have been in your shoes.

Stay up to date on all things Cambio with product updates, announcements and more!

Vent to other Cambio members working on improving their credit scores

Debt dragging you down? It happens to so many of us. And debt collectors like Monarch Recovery Management often make a bad situation worse with

Navigating loans can feel overwhelming these days, especially when you’re in a crisis. Your financial security rides on access to credit, yet all the options

That shiny “$500 Down on a Car, No Credit Check” sign practically leaps off the dealership lot. For folks with bad credit or short cash,

That familiar feeling of dread when you see the State Collection Service calling. As one of the most relentless collectors around, they have a reputation

That familiar feeling of dread when you see yet another call from Credit Management LP on your phone. As a major debt collector, they’re experts

Navigating credit reports can really make your head spin. With inconsistent reporting schedules, constant changes in your balances, and potential policy shifts over time, it’s

Poor credit scores do more than just jeopardize your financial future, and services like American Profit Recovery don’t help. Credit scores can massively affect your

Occasionally, when you check your credit score, you may notice accounts you don’t recall working with or applying for. They might seem like nothing, perhaps

While up to 60% of Americans have a credit score of 700 or more, that still leaves a whopping 40% with credit scores below 700.